Please visit Search Engine Land for the full article.

from Search Engine Land: News & Info About SEO, PPC, SEM, Search Engines & Search Marketing https://ift.tt/39rUOQu

via

This post is a part of Made @ HubSpot, an internal thought leadership series through which we extract lessons from experiments conducted by our very own HubSpotters.

Platforms are embedded in our daily lives — whether we realize it or not.

Have you recently … ordered food from a service like GrubHub or made a reservation using OpenTable? Booked a ride using Lyft? Used your phone to check your email? All of these seamless interactions require systems to talk to each other via open platforms.

What about at work? How many tools do you use to do your job? Do you spend a lot of time updating disparate systems, or do you use a connected stack of technologies to keep things up-to-date? If it’s the latter, you have a platform to thank for your saved time.

A platform makes it possible to connect tools, teams, data, and processes under one digital roof. It’s the nucleus of all systems and allows you to connect all your favorite tools seamlessly using integrations. An integration allows disparate systems to talk to each other. By joining tools via integrations, a change made in System A automatically carries through to System B.

Leveraging platforms and integrations hasn’t always been commonplace. A couple of years ago, HubSpot Research found that 82% of salespeople and marketers lost up to an hour per day managing siloed tools — a costly mistake.

Today, employees recognize that integrating technologies to do their jobs isn’t an option but a requirement. Individual employees are opting to connect their tools and, on average, leverage eight apps to do their job.

Employees and businesses alike run on connected applications. Okta found that it’s small-mid sized customers (defined as companies with less than 2,000 employees) average 73 apps — up 38% from last year. While larger customers (companies with over 2,000 employees) leverage closer to 130 apps — up 68% from the past year.

From personal life to work, platforms have become a staple in our day-to-day. These platforms are well-oiled machines that initiate seamless connections between technologies. Today, the consumer not only anticipates but also expects their systems to connect — raising the bar for companies to make it possible.

But more tools shouldn’t mean more friction. At HubSpot, we want to help our customers connect their tools on our platform to reduce friction and grow better. Customers should have tools and solutions to solve their needs, regardless of if HubSpot built them. Connecting tools allows for uniform data, processes, and experiences. This year, we’re experimenting with ways to expose integrations to our customers to increase adoption.

However, as a platform scales, it becomes increasingly tricky for customers to navigate exhaustive lists of integrations and identify what's relevant to them. We recognized this at HubSpot and began experimenting with paid ads to see if this could be a valuable distribution channel to our customers.

At the end of Q4, the Platform Marketing team decided to use some leftover budget to try a channel we hadn’t yet proven viable for integration adoption — paid ads.

We hypothesized that we could influence the adoption of an integration through paid ads. To test our hypothesis, we ran a retargeting campaign for three integrations on Facebook. The ads were surfaced to HubSpot’s retargetable audience.

These ads featured three HubSpot-built integrations: Slack, Wordpress, and Eventbrite. We selected these integrations because they are natively built (built by HubSpot) and structured in a way that allowed us to measure multi-touch attribution.

By leveraging Google Tag Manager on the in-app integration directory, custom UTM parameters, and funnel reports, we were able to measure all steps from viewing the ad to installing the integration. Before launching the campaign, we tested our Google Analytics custom funnel reports by completing all actions — including installing the integrations to make sure they worked as designed.

Before running the campaign, we made the conscious decision to split our budget evenly across all three integration ads — regardless if one ad outperformed the others. We did this to minimize variables for the experiment.

Because we ran ads through November and December, we decreased spending from $130 dollars a day to $5 a day on and around holidays. We did this to “pause” the campaign on days where the ads would get lost in the noise, as this data could skew overall results.

Lastly, we determined our success metrics. Because we didn’t have apples-to-apples benchmark data for integration paid ads, we worked with our paid team to establish reasonably similar benchmark data. While it wasn’t a direct comparison, we were curious to see how ads could influence multi-step actions. We evaluated our performance based on click-through rates (CTR), cost per click (CPC), and cost per acquisition.

The integration ads surpassed our benchmark data for click-through rate (CTR), cost per click (CPC), and cost per acquisition at the 7-, 30-, and 44-day marks — supporting our initial hypothesis and prediction.

The 30-day CTR for our integration ads was higher than the 7-day and 30-day CTR for the benchmark data, which is surprising as we expected the audience to become more fatigued over time.

Fatigue can be measured by the frequency a user views the same ad. For example, at HubSpot, we look at if a viewer has seen the same ad over 2.5 times within 30 days, which we consider high. Additionally, we kept an eye out for an increasing cost per acquisition.

Paid ads for these integrations was attractive to our retargetable audience and a legitimate acquisition point for HubSpot. It helped us influence adoption of integrations --- resulting in hundreds of installs in the featured technologies. It also provided us with a data point we’ve been curious to see — the cost of an install.

When considering the value and acquisition cost of an install, it’s helpful to understand the impact on the business. At HubSpot, our customers with integrated stacks of technologies tend to be more successful — and they stick around.

This makes sense — as the more apps installed, the higher the likelihood someone will stick around. This is a common finding among platform companies.

On a recent trip to San Francisco HubSpot’s VP of Platform Ecosystem Scott Brinker found that “a common pattern on platforms is that the more apps a customer integrates into their system, the higher their retention rate will be — for both the platform and the apps integrated into it.”

Connecting their tools allows customers to access all their data in one core system while staying flexible and adaptable to their needs as they grow.

Since HubSpot doesn’t currently charge integrators to be part of our ecosystem, spending money to drive a net new install may seem counterintuitive. When weighing the long-term benefits of an install for customer value and retention, we are able to determine what is a reasonable cost per install. The experiment cost was worth the insight, as it allowed us to gain a baseline understanding of the cost per acquisition of an integration install.

Ultimately you can determine if the long-term value outweighs the upfront cost. (While directional value is a good baseline, you’d ideally look to lifetime value [LTV] to establish actual value.)

Our experiment with paid ads outperformed our expectations and helped us reach a larger audience than we anticipated. It became clear that this was and is a viable channel for us to increase adoption of integrations and better understand the cost per integration install.

Future looking, we could alter who we target to see how it impacts CTR. We could leverage enrichment software like Datanyze or Clearbit to see if users have tools and cross-reference install data to create a list of folks using tools we integrate with but have yet to connect to. Alternatively, we could leverage this data to target a group of users going through onboarding to encourage them to connect existing tools to HubSpot.

Additionally, we could look through the required steps to connect an integration and consider how we could reduce them to simplify the process for our users and potentially increase our CTR.

Not a platform company? No problem. This retargeting campaigns can be leveraged to evaluate other valuable actions for your users, such as sign-ups, free trials, or event registration.

With over 2.7 billion monthly active users and 1.82 billion daily users, Facebook is the largest social network in the world. What began as a way for college students to network has become an essential marketing tool for more than 90 million small businesses.

All of those users generate a lot of data.

To help companies harness the massive amount of information created within the platform, Facebook released their Insights tool, which shares data about the best day to post, the ideal time to post, and what posts are performing well.

If you're marketing on Facebook, understanding how all those numbers relate to your business and audience can be confusing at first.

But worry not. This post explains how to analyze Facebook data to get valuable metrics about who's coming to your page and clicking around. By the end, you'll have a better understanding of how Insights can help you connect with both current and potential customers.

Running a new Facebook Business Page? Find everything you need to know to elevate your paid and organic efforts in this Facebook Marketing Course.

Facebook Insights is separated into two main categories: Audience Insights and Page Insights.

This post focuses on Audience Insights, to help you understand both existing and potential customers. For an in-depth look at how to gather information from Page Insights, check out this guide to Facebook Marketing.

To access the data gold mine in Audience Insights, you first have to create a business Page. Once your Page is set up, navigate to Audience Insights by clicking Analyze and Report in your Business Tools menu. Now comes the sleuthing. Pull up your company's target audience profile for reference, because it's time to do research.

A pop-up will appear and ask you to pick between the following options:

This part requires some strategy. Are you using Insights to build a buyer persona, see if your strategy is attracting the right people, learn about your audience's interests, or something else entirely? By having a goal in mind, it's easier to put the information to use.

With your goal set, it's time to narrow down the audience. You can filter based on:

Knowing where in the world your audience lives is helpful for many reasons. If you're an online shop looking to expand, maybe you want to learn whether a specific country is interested in your products.

If your company has a physical location, select your city for relevant local metrics. And if you're not bound to any location constraints, keep it open by including countries worldwide.

All Facebook users must be 18 years and older, so keep that in mind when evaluating audiences. If you have a specific buyer persona you're researching, filter according to that age range.

But if you're looking to expand your audience, it's worthwhile to extend your age range or consider both genders to see if you're missing out on potential customers.

This is where filtering gets fun — and a little complicated. Keep your search broad by selecting a handful of common interests, like food and reading, or select dozens of interests for a focused pool of people.

You have freedom to play with drop down filters or type anything that comes to mind into the search bar. Cooking, Entertainment, Adventure, Flying, Tech, Cake.

The list goes on, so let your imagination run wild. Just keep an eye on the number of people in your audience as you refine. If it drops below 1,000 people, Facebook won't populate the data.

This filter shows the top "liked" Pages by people within your audience profile. If you're scouting for competitors, this can let you know who to watch. Maybe you're looking for content inspiration, and browsing connected Pages will give you ideas for a campaign collaboration or promotional giveaway. Either way, it's good to know what other Pages pop up in your audience's newsfeed.

Sound the applause — you've filtered down your audience profile. Now it's time to dig in further to four categories: Demographics, Page Likes, Location, and Activity.

Facebook Insights lets you go beyond the basics to see audience information including Language, Relationship Status, Education, Job Titles, and Market Segments. Let's say you're a new food blogger targeting men ages 18-32.

If you plug in that information, you can get a detailed look at what your audience does for work, how educated they are, or even whether they're primarily cooking for one or more people.

If your ideal audience turns out to largely be single with time-consuming office jobs, this can help focus your content strategy.

Maybe your audience would like a post about easy lunch ideas for work or meals that are even better as leftovers. I'm generalizing here, but the more you dig into demographics, the more data you have to hone your marketing efforts.

Similar to the Interests filter, this option shows what your audience likes. Check out the Top Categories to learn what people care about the most, with options like Movies, Charities, Companies, Music, Public Figures, News and Media, and Products.

Maybe those men whipping up meals for one are interested in TV series like "The Chef Show" or "Chef's Table." If you were to create a blog post round-up of your favorite cooking shows or episodes, it would likely do well among that audience. The key here is to look at what content is relevant both in and out of your industry to review competitors and connected interests.

Use this filter to explore the top countries, cities, and languages of your audience profile. Say you're based in the United States but discover your audience has a major presence in Montreal, Canada.

It could be worth adjusting your marketing efforts to include content that speaks to both Americans and Canadians. And if you do expand your audience, you may even consider adding a French language option to your website to cater to Québécois customers.

See how active your audience is compared to the average Facebook user. The most important information in this section is the activity within the past 30 days, broken down by actions like Comments, Posts Liked, Posts Shared, and Ads Clicked.

Maybe you're interested in running Facebook Ads but are unsure if anyone in your audience would click. With the Activity data, you have a better idea of how many people would take action. For a more detailed look at how to analyze Facebook Ad performance, take a look at this guide to Facebook Advertising.

Now you can wield the power of Audience Insights to help you build buyer personas, hone in your target audience, and expand your customer reach. But if you're on a research roll, you can explore more metrics under Page Insights to see how your content is performing, what people are resonating with, and what posts to promote.

So the next time you question whether you're attracting the right followers or are looking for out-of-the-box ideas to engage your audience, pull up Facebook Insights and put the data to work.

As a marketer, you're often tasked with accomplishing two main goals: making beautiful content that builds your brand recognition and tells your story ... and generating qualified leads that will help you grow your business.

Traditional marketing ethos may consider those to be two different streams of work — crafting impactful video ads, and digging up lower-funnel users — but it doesn't have to be that way. If you're not using video as part of your lead generation tactics, you're missing out on a serious opportunity to create impactful content that directly translates to more leads for your business.

Megha Muchhala, Product Marketing Manager at Vimeo, shares some key insights on how to integrate your video efforts with your lead generation tactics.

We all know how useful including video on a landing page or an email campaign can be in boosting your conversion rates, but there are also optimizations you can make to your videos themselves that will give you a marketing edge.

Rather than simply relying on CTAs to boost your follows or website traffic, marketers should utilize in-video contact forms to capture specific information from leads. This can be as simple as gathering their email, or more detailed to capture demographic information, short answers to collect personal insight, or other actionable data.

Include these forms on videos embedded throughout your digital ecosystem across your website, landing pages, and even blogs to passively build qualified leads, fast.

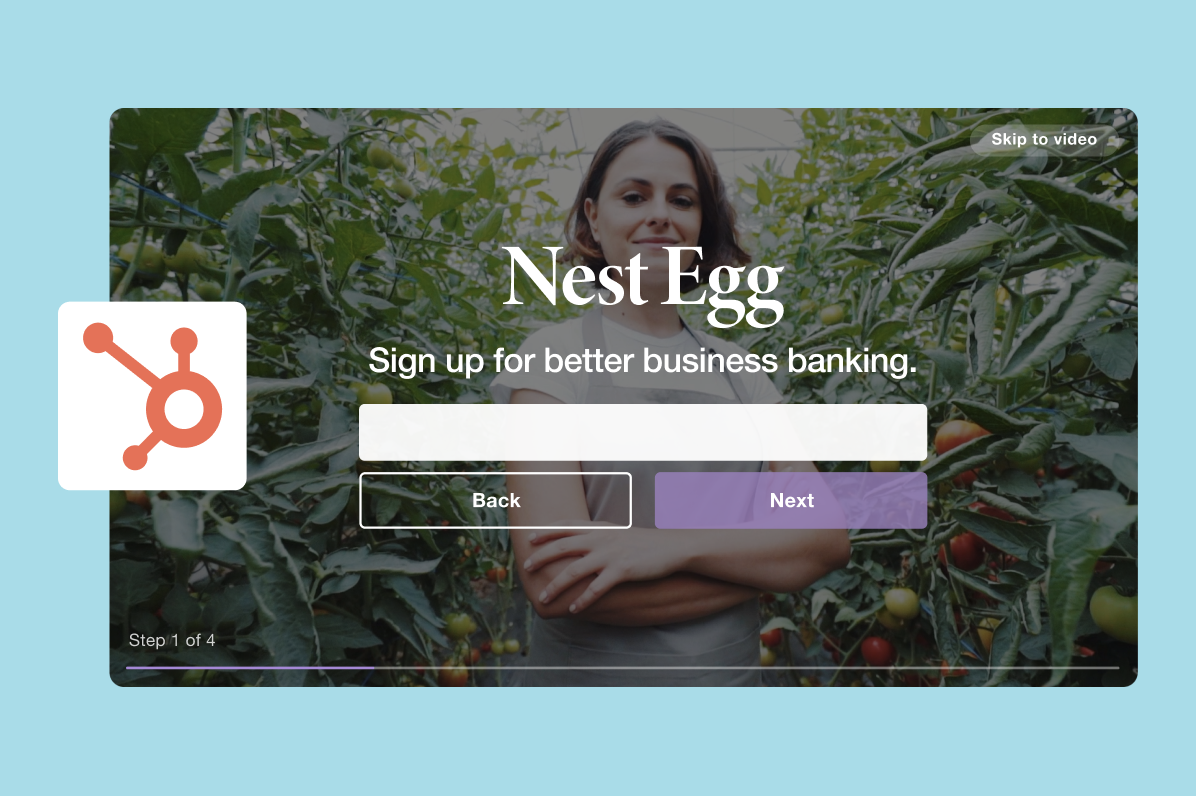

While you've probably heard of multi-step forms before, it's possible you have yet to use one. That's a shame, because it's a format that's been shown to increase form conversion by up to 52.9%.

A multi-step form is one that breaks a longer contact form up into a more digestible series of questions, which should boost user experience and, in turn, increase conversions.

A multi-step form is one that breaks a longer contact form up into a more digestible series of questions, which should boost user experience and, in turn, increase conversions.

Using a multi-step form reduces friction and helps you wait to ask for more user guarded information (like an email address) until the user is already a few steps into the process.

You always want your user experience to stay tip-top no matter how they're viewing your video content. We know you take the care to create videos in different formats and aspect ratios depending on your hosting plans, and your contact forms should be no different. Utilize a contact form that displays on mobile and desktop to ensure you're capturing all potential leads.

There are pros and cons to dropping contact forms at any point throughout your video, and the right choice generally depends on what kind of content you're sharing.

If you're offering premium or long-form content, gating your video with a contact form right up front is a great way to boost leads. If you're telling a shorter form story, placing a contact form in the middle or just before a climax can be incredibly effective in terms of incentivizing information sharing.

And while placing your contact form at the end of the video can be risky (considering 50% of viewers stop watching a video after one minute), it can also generate the most qualified leads: those who've watched all the way to the end are the most likely to be engaged with your brand or story anyway. Whatever you choose, we recommend setting up a few A/B tests to determine the best placement. A little testing can go a long way!

And speaking of placement, consider your video distribution when deciding your form messaging and placement. Audiences watching a video on your blog are likely far more invested (and thus likely to share some honest info and opinions) than those catching a video on your homepage. Alter your messaging accordingly!

Now that you know about the joys of in-video lead capture, let's review some final tips to make the most of your tactics.

Make sure to consider the sales funnel when optimizing your contact forms. If you know video is your main acquisition tool (meaning, the first piece of your brand consumers see before becoming fans), know that they might not be so willing to share lots of information with you upfront.

Customize your asks as they relate to steps in the funnel: users who are brand loyalists are a lot quicker to give up info than those who've just spotted you via a sponsored ad.

Leads are great, but if you don't engage them, they're pretty much useless. When capturing leads via contact forms, sync them to your email service provider to make it easy to nurture them. (Just so you know: Vimeo users can automatically sync their leads directly into their HubSpot account, making it simpler than ever to connect with your prospective customers.) Then, keep them engaged! Develop follow-up email campaigns around specific prominent demographics and use your gleaned data to make them even more engaging. Even better, further increase your click-through by embedding GIFs of your videos in your follow-up email campaigns to stand out and get noticed by leads.

Then, keep them engaged! Develop follow-up email campaigns around specific prominent demographics and use your gleaned data to make them even more engaging. Even better, further increase your click-through by embedding GIFs of your videos in your follow-up email campaigns to stand out and get noticed by leads.

Your ability to generate leads in your video doesn't mean a whole lot if no one watches your content. SEO can be a massively helpful organic discovery tool to send users to your business. Take the extra time to optimize your website, landing page, and video itself for maximum discoverability.

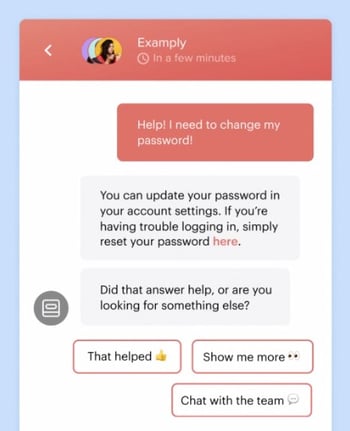

Whether it’s on Facebook Messenger, their website, or even text messaging, more and more brands are leveraging chatbots to service their customers, market their brand, and even sell their products.

But even though most chatbots can handle moderately sophisticated conversations, like welcome conversations and product discovery interactions, the if/then logic that powers their conversational capabilities can be limiting. For instance, if a customer asks a unique yet pressing question that you didn’t account for when designing your chatbot’s logic, there’s no way it can answer their question, which hangs your customer out to dry and ultimately leaves them dissatisfied with your customer service.

Fortunately, the next advancement in chatbot technology that can solve this problem is gaining steam -- AI-powered chatbots.

By leveraging machine learning and NLP, AI-powered chatbots can understand the intent behind your customers’ requests, account for each customer’s entire conversation history when it interacts with them, and respond to their questions in a natural, human way.

If you’re currently using a standard chatbot, but want to upgrade to an AI-powered one, we’ve put together a list of the best AI chatbots for 2021. Read on to find the right one for you.

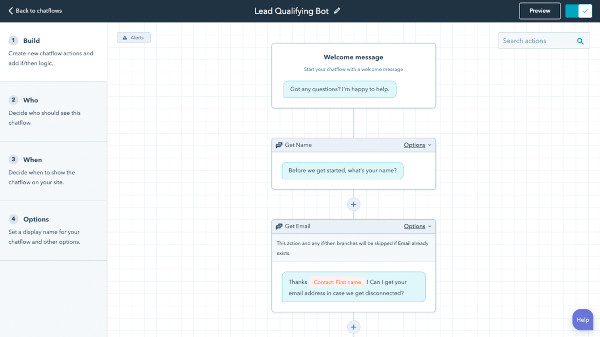

HubSpot has an easy and powerful chat builder software that allows you to automate and scale live chat conversations. Your customers will be able to get answers to frequently asked questions, book meetings, and navigate the site. At the same time, their answers are saved in your CRM, allowing you to qualify leads and trigger automation. Keep in mind that HubSpot's chat builder software doesn't quite fall under the category of "AI chatbot" because it uses a rule-based system. However, HubSpot does have code snippets, allowing you to leverage the powerful AI of third-party NLP-driven bots such as Dialogflow.

Because HubSpot is a CRM platform, using the HubSpot chatbot in conjunction with code snippets gives you the advantage of easy integration across your marketing, sales, and service tools.

Intercom is software that supports live chat, chat bots, and more to provide messenger-based experiences for prospects. Using machine learning and behavioral data, Intercom can answer up to 33% of queries and provide a personalized experience along the way.

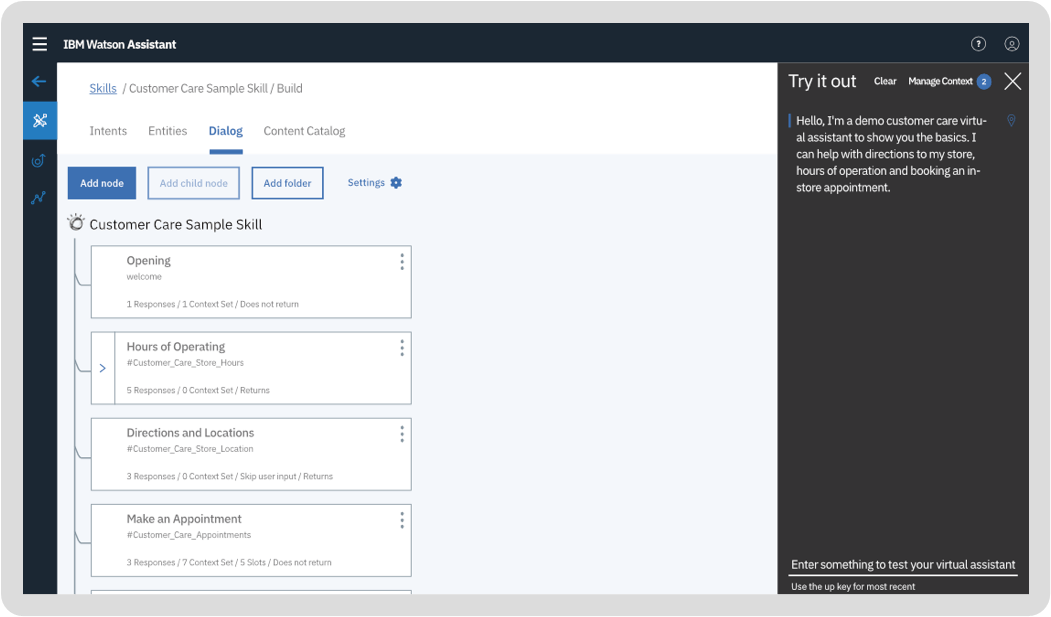

Developed by one of the leaders in the AI space, IBM, Watson Assistant is one of the most advanced AI-powered chatbots on the market. Pre-trained with content from your specific industry, Watson Assistant can understand your historical chat or call logs, search for an answer in your knowledge base, ask customers for more clarity, direct them to human representatives, and even give you training recommendations to hone its conversational abilities.

Watson Assistant can run on your website, messaging channels, customer service tools, and mobile app. The chatbot also comes with a visual dialog editor, so you don’t need any coding experience to develop it.

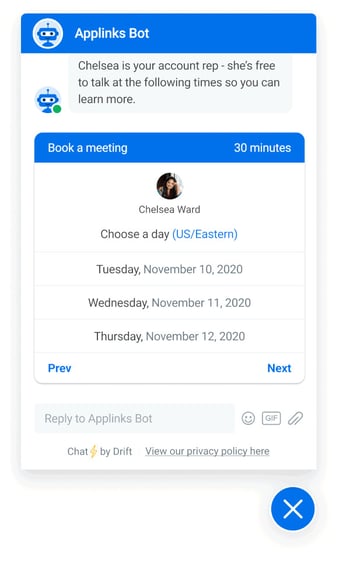

Drift provides conversational marketing and sales software powered by both automation (rule-based) and artificial intelligence (NLP). According to their website, "Drift's conversational AI is trained on over 6 billion conversations to identify the patterns that engage and convert visitors into qualified pipeline." This means the machine learning that the chatbot comes with is already pre-trained and ready to go.

-14.png?width=400&name=pasted%20image%200%20(1)-14.png)

Trusted by customers like Intuit, Edible Arrangements, and Vodafone, Bold360 patented its own natural language processing technology to help brands build chatbots that can understand your customers’ intent without the need of keyword matching and learn how to deliver the most accurate answers to them.

Bold360’s conversational AI can interpret complex language, remember the context of an entire conversation, and reply to customers with natural responses. Customers can even buy your products through the chatbot. You can also give your chatbot its own personality and run it on most messaging channels.

Zendesk offers live chat and chatbots as part of their Zendesk Chat service. Built with powerful automation combined with the technology of Answer Bot and Flow Builder for creating AI-powered conversation flows, it allows you to configure your chatbot to answer common customer questions without writing code.

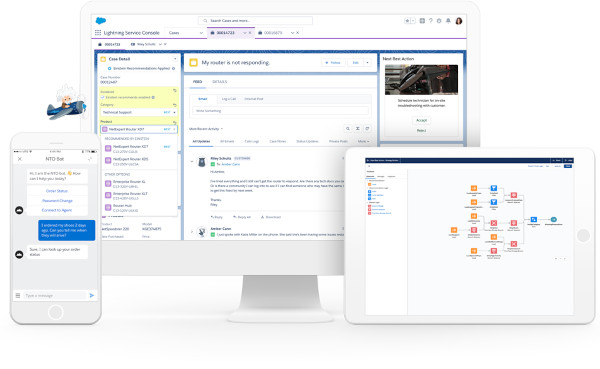

Salesforce Einstein is AI technology that uses predictive intelligence and machine learning to power many Salesforce features, including Salesforce's Service Cloud and chatbot offerings. It is capable of solving customer queries with its intelligent conversational features, and you can count on it for triage and routing and data-driven insights.

-11.png)

Armed with deep-learning based natural language understanding and adaptive multi-taking capabilities, Ruali, an AI-powered chatbot for enterprise brands, can understand the context of a conversation, predict user behavior, grasp customer preferences, take actions, switch to different tasks, and ask customers for more clarification.

Rulai also integrates with most messaging channels, customer service software, enterprise business software, and cloud storage platforms. You can either build a Ruali chatbot from scratch with its drag-and-drop design console and let its AI adapt to your customers or you can implement a pre-trained chatbot that has been fed data from your specific industry.

-10.png)

By collecting over 20 years of messaging transcript data and feeding it to their AI-powered chatbot, LivePerson can automate almost every industry’s messaging and integrate with most messaging channels like your website, mobile app, Apple Business Chat, text messaging, Google Rich Business messaging, Line, Facebook Messenger, WhatsApp, and Google AdLingo.

LivePerson’s BotStudio also lets you build chatbots from scratch, without any coding knowledge, and its analytics dashboard can track metrics like real-time sentiment, bot containment rate, bot conversation time, total conversation time, average order value, and bot contained sales, allowing you to grasp the impact your chatbot has had on your business’ bottom line.

-9.png?width=450&name=pasted%20image%200%20(4)-9.png)

Designed specifically for enterprise brands, Inbenta’s chatbot leverages machine learning and its own natural language processing engine to detect the context of each customer conversation and accurately answer their questions. Inbenta also offers a dialog manager, which allows you to craft custom conversation flows and paths.

Additionally, when Inbenta’s chatbot realizes that one of your customers needs to talk to a human, it’ll escalate the conversation to the appropriate support agent. To make your chatbot seem more human, you create a custom avatar for it, too.

.png)

Trusted by customers like Medium, Shopify, and MailChimp, Ada is an AI-powered chatbot that features a drag-and-drop builder that you can use to train it, add GIFs to certain messages, and store customer data.

Ada can also integrate with most messaging channels and customer service software, send personalized content to your customers, ask for customer feedback, and report on your bots’ time, effort, and cost savings. According to their website, Ada has saved their customers over $100 million in savings and 1 billion minutes of customer service effort.

-5.png?width=350&name=pasted%20image%200%20(5)-5.png)

Vergic offers an AI-powered chatbot that can serve as your businesses’ first line of customer support, handle transactional chats, and transfer more complicated problems to your actual customer service agents. It’s like a hybrid chatbot that can boost your employees’ productivity.

By leveraging natural language processing and natural language understanding, Vergic can also perform sentiment analysis, share documents, highlight pages, manage conversational workflows, and report on chatbot analytics.

Editor's note: This post was originally published in March 2019 and has been updated for comprehensiveness.

Today's consumers have a lot of power. They can research your product or service and make purchase decisions entirely on their own.

Moreover, rather than talking to one of your sales reps, they're more likely to ask for referrals from members of their networks or read online reviews.

With this in mind, have you adapted your marketing strategy to complement the way today's consumers research, shop, and buy?

To do just that, you must have a deep understanding of who your buyers are, your specific market, and what influences the purchase decisions and behavior of your target audience members.

Enter: Market Research.

Whether you're new to market research, this guide will provide you with a blueprint for conducting a thorough study of your market, target audience, competition, and more.

Market research is the process of gathering information about your business's buyers personas, target audience, and customers to determine how viable and successful your product or service would be, and/or is, among these people.

Market research allows you to meet your buyer where they are. As our world (both digital and analog) becomes louder and demands more and more of our attention, this proves invaluable. By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into a wide variety of things that impact your bottom line including:

As you begin honing in on your market research, you'll likely hear about primary and secondary market research. The easiest way to think about primary and secondary research is to envision to umbrellas sitting beneath market research: one for primary market research and one for secondary market research.

Beneath these two umbrellas sits a number of different types of market research, which we'll highlight below. Defining which of the two umbrellas your market research fits beneath isn't necessarily crucial, although some marketers prefer to make the distinction.

So, in case you encounter a marketer who wants to define your types of market research as primary or secondary — or if you're one of them — let's cover the definitions of the two categories next. Then, we'll look at the different types of market research in the following section.

There are two main types of market research that your business can conduct to collect actionable information on your products including primary research and secondary research.

Primary research is the pursuit of first-hand information about your market and the customers within your market. It's useful when segmenting your market and establishing your buyer personas. Primary market research tends to fall into one of two buckets: exploratory and specific research.

This kind of primary market research is less concerned with measurable customer trends and more about potential problems that would be worth tackling as a team. It normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

Specific primary market research often follows exploratory research and is used to dive into issues or opportunities the business has already identified as important. In specific research, the business can take a smaller or more precise segment of their audience and ask questions aimed at solving a suspected problem.

Secondary research is all the data and public records you have at your disposal to draw conclusions from(e.g. trend reports, market statistics, industry content, and sales data you already have on your business). Secondary research is particularly useful for analyzing your competitors. The main buckets your secondary market research will fall into include:

These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — lots of bang for your buck here.

Government statistics are one of the most common types of public sources according to Entrepreneur. Two U.S. examples of public market data are the U.S. Census Bureau and the Bureau of Labor & Statistics, both of which offer helpful information on the state of various industries nationwide.

These sources often come in the form of market reports, consisting of industry insight compiled by a research agency like Pew, Gartner, or Forrester. Because this info is so portable and distributable, it typically costs money to download and obtain.

Internal sources deserve more credit for supporting market research than they generally get. Why? This is the market data your organization already has!

Average revenue per sale, customer retention rates, and other historical data on the health of old and new accounts can all help you draw conclusions on what your buyers might want right now.

Now that we've covered these overarching market research categories, let's get more specific and look at the various types of market research you might choose to conduct.

Interviews allow for face-to-face discussions (in-person and virtual) so you can allow for a natural flow or conversation and watch your interviewee's body language while doing so.

Focus groups provide you with a handful of carefully-selected people that you can have test out your product, watch a demo, provide feedback, and/or answer specific questions.

Product or service use research offers insight into how and why your audience uses your product or service, and specific features of that item. This type of market research also gives you an idea of the product or service's usability for your target audience.

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX, what roadblocks they hit, and which aspects of it could be easier for them to use and apply.

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, what they need from your business and brand, and more.

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics — this way, you can determine effective ways to meet their needs, understand their pain points and expectations, learn about their goals, and more.

Pricing research gives you an idea of what similar products or services in your market sell for, what your target audience expects to pay — and is willing to pay — for whatever it is you sell, and what's a fair price for you to list your product or service at. All of this information will help you define your pricing strategy.

Competitive analyses are valuable because they give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry, what your target audience is already going for in terms of products like yours, which of your competitors should you work to keep up with and surpass, and how you can clearly separate yourself from the competition.

Customer satisfaction and loyalty research give you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g. loyalty programs, rewards, remarkable customer service). This research will help you discover the most-effective ways to promote delight among your customers.

Brand awareness research tells you about what your target audience knows about and recognizes from your brand. It tells you about the associations your audience members make when they think about your business and what they believe you're all about.

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. It requires experimentation and then a deep dive into what reached and resonated with your audience so you can keep those elements in mind for your future campaigns and hone in on the aspects of what you do that matters most to those people.

Now that you know about the categories and types of market research, let's review how you can conduct your market research.

Here's how to do market research step-by-step.

Before you dive into how customers in your industry make buying decisions, you must first understand who they are.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

They help you visualize your audience, streamline your communications, and inform your strategy. Some key characteristics you should be keen on including in your buyer persona are:

The idea is to use your persona as a guideline for how to effectively reach and learn about the real audience members in your industry. Also, you may find that your business lends itself to more than one persona — that's fine! You just need to be thoughtful about each specific persona when you're optimizing and planning your content and campaigns.

To get started with creating your personas, check out these free templates, as well as this helpful tool.

Now that you know who your buyer personas are, use that information to help you identify a group to engage to conduct your market research with — this should be a representative sample of your target customers so you can better understand their actual characteristics, challenges, and buying habits.

The group you identify to engage should also be made of people who recently made a purchase or purposefully decided not to make one. Here are some more guidelines and tips to help you get the right participants for your research.

When choosing who to engage for your market research, start by focusing on people who have the characteristics that apply to your buyer persona. You should also:

Aim for 10 participants per buyer persona.We recommend focusing on one persona, but if you feel it's necessary to research multiple personas, be sure to recruit a separate sample group for each one.

You may want to focus on people that have completed an evaluation within the past six months — or up to a year if you have a longer sales cycle or niche market. You'll be asking very detailed questions so it's important that their experience is fresh.

You want to recruit people who have purchased your product, purchased a competitor's product, and decided not to purchase anything at all. While your customers will be the easiest to find and recruit, sourcing information from those who aren't customers (yet!) will help you develop a balanced view of your market.

Here are some more details on how to select this mix of participants:The best way to make sure you get the most out of your conversations is to be prepared. You should always create a discussion guide — whether it's for a focus group, online survey, or a phone interview — to make sure you cover all of the top-of-mind questions and use your time wisely.

(Note: This is not intended to be a script. The discussions should be natural and conversational, so we encourage you to go out of order or probe into certain areas as you see fit.)

Your discussion guide should be in an outline format, with a time allotment and open-ended questions for each section.

Wait, all open-ended questions?

Yes — this is a golden rule of market research. You never want to "lead the witness" by asking yes and no questions, as that puts you at risk of unintentionally swaying their thoughts by leading with your own hypothesis. Asking open-ended questions also helps you avoid one-word answers (which aren't very helpful for you).

Here's a general outline for a 30-minute survey for one B2B buyer. You can use these as talking points for an in-person interview, or as questions posed on a digital form to administer as a survey to your target customers.

Ask the buyer to give you a little background information (their title, how long they've been with the company, and so on). Then, ask a fun/easy question to warm things up (first concert attended, favorite restaurant in town, last vacation, etc.).

Remember, you want to get to know your buyers in pretty specific ways. You might be able to capture basic information such as age, location, and job title from your contact list, there are some personal and professional challenges you can really only learn by asking.

Here are some other key background questions to ask your target audience:

Now, make a transition to acknowledge the specific purchase or interaction they made that led to you including them in the study. The next three stages of the buyer's journey will focus specifically on that purchase.

Here, you want to understand how they first realized they had a problem that needed to be solved without getting into whether or not they knew about your brand yet.

Now you want to get very specific about how and where the buyer researched potential solutions. Plan to interject to ask for more details.

If they don't come up organically, ask about search engines, websites visited, people consulted, and so on. Probe, as appropriate, with some of the following questions:

Here, you want to wrap up and understand what could have been better for the buyer.

List your primary competitors — keep in mind listing the competition isn't always as simple as Company X versus Company Y.

Sometimes, a division of a company might compete with your main product or service, even though that company's brand might put more effort in another area.

For example. Apple is known for its laptops and mobile devices but Apple Music competes with Spotify over its music streaming service.

From a content standpoint, you might compete with a blog, YouTube channel, or similar publication for inbound website visitors — even though their products don't overlap with yours at all.

And a toothpaste company might compete with magazines like Health.com or Prevention on certain blog topics related to health and hygiene even though the magazines don't actually sell oral care products.

To identify competitors whose products or services overlap with yours, determine which industry or industries you're pursuing. Start high-level, using terms like education, construction, media & entertainment, food service, healthcare, retail, financial services, telecommunications, and agriculture.

The list goes on, but find an industry term that you identify with, and use it to create a list of companies that also belong to this industry. You can build your list the following ways:

Search engines are your best friends in this area of secondary market research. To find the online publications with which you compete, take the overarching industry term you identified in the section above, and come up with a handful of more specific industry terms your company identifies with.

A catering business, for example, might generally be a "food service" company, but also consider itself a vendor in "event catering," "cake catering," "baked goods," and more.

Once you have this list, do the following:

After a series of similar Google searches for the industry terms you identify with, look for repetition in the website domains that have come up.

Examine the first two or three results pages for each search you conducted. These websites are clearly respected for the content they create in your industry, and should be watched carefully as you build your own library of videos, reports, web pages, and blog posts.

Feeling overwhelmed by the notes you took? We suggest looking for common themes that will help you tell a story and create a list of action items.

To make the process easier, try using your favorite presentation software to make a report, as it will make it easy to add in quotes, diagrams, or call clips.

Feel free to add your own flair, but the following outline should help you craft a clear summary:

Within a market research kit, there are a number of critical pieces of information for your business's success. Let's take a look at what those different kit elements are next.

Pro Tip: Upon downloading HubSpot's free Market Research Kit, you'll receive editable templates for each of the given parts of the kit as well as instructions on how to use the templates and kit, and a mock presentation that you can edit and customize.

Download HubSpot's free, editable market research report template here.

Use Porter's Five Forces Model to understand an industry by analyzing five different criteria and how high the power, threat, or rivalry in each area is — here are the five criteria:

Both market surveys and focus groups (which we'll cover in the next section) help you uncover important information about your buyer personas, target audience, current customers, market, competition, and more (e.g. demand for your product or service, potential pricing, impressions of your branding, etc.).

Surveys should contain a variety of question types, like multiple choice, rankings, and open-ended responses. Ask quantitative and short-answer questions to save you time and to more easily draw conclusions. (Save longer questions that will warrant more detailed responses for your focus groups.)

Here are some categories of questions you should ask via survey:

Focus groups are an opportunity to collect in-depth, qualitative data from your real customers or members of your target audience. You should ask your focus group participants open-ended questions. While doing so, keep these tips top of mind:

Conducting market research can be a very eye-opening experience. Even if you think you know your buyers pretty well, completing the study will likely uncover new channels and messaging tips to help improve your interactions.

Editor's note: This post was originally published in March 2016 and has been updated for comprehensiveness.