Do you remember where you were the first time you heard about bitcoin? I do. The year was 2013. One of my friends briefly mentioned bitcoin while discussing how advancements in technology made it much more challenging to create timely policy. He used bitcoin as an example because it was the currency of choice for Silk Road: the now-defunct drug trafficking website. Just a little over five years ago, bitcoin was primarily used in the dark corners of the internet to purchase illicit goods on the black market. With that knowledge, I pushed bitcoin to a dark corner of my mind … until recently when I saw that the Winklevoss twins had become bitcoin billionaires. Say what?

The price of bitcoin in June 2013? About $100. The price of bitcoin today? $11,392. Yes, I am suffering from an extreme case of FOMO. Thanks for asking.

I bet many of you have your own bitcoin story. Maybe you bought bitcoin early and sold it a few years ago when it started to see marginal success? Maybe you just heard about it a few weeks ago and felt like it's too late to get in the game? Or maybe you're just confused by all these headlines about cryptocurrencies, digital mining, and ... CryptoKitties? Hey, I get you. My cat is very much alive and very much scratches my new couch.

But what if I told you the biggest opportunity for businesses of any kind is actually related to the technology that underlies bitcoin — known as blockchain. Blockchain, the public ledger that records all bitcoin transactions, is more than just a fad — it’s changing life as we know it.

Don't believe me? Follow along to learn more about blockchain and how it works, who’s using it, and the future of the technology. Feel free to email, bookmark, or jump to the section that interests you most.

All About Blockchain

Okay, I know what you’re thinking, this writer’s exaggerating — there’s no way this technology is “changing life as we know it.” While I’ve been known to occasionally have a flair for the dramatic, I promise that this is not one of those times. The uses for blockchain technology extend far beyond bitcoin. But what is blockchain?

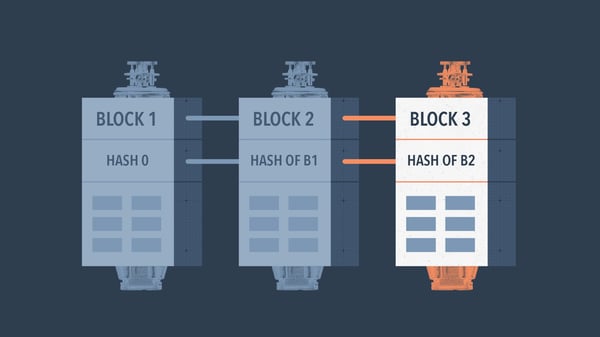

These transactions get packaged into blocks, and each block gets verified by other users in the system by completing a math problem. Once a block gets verified, it cannot be altered and gets added to a chain of other permanent, previously verified blocks. The records held within these blocks form a blockchain, and the blockchain's users all keep track of this record. It's basically a giant, shared ledger, but in practice, it's much more exciting than that.

Let’s say the hoverboard you bought last year isn’t all it’s cracked up to be — you feel much safer with your feet solidly on the ground. You could use a third-party seller like eBay to sell it. These sellers act as the marketplace that connects you (the seller) to potential buyers; they make money by charging fees. In this case, let’s pretend the buyer is from Germany. When you make a sale on eBay, the platform verifies the transaction with your bank and the purchaser’s bank. It also confirms your hoverboard and the end buyer both exist. But if you use blockchain technology to sell your hoverboard, you can cut out all the middlemen while still maintaining a safe, speedy, and secure transaction — even internationally. No eBay, no banks, no fees, and no exchange rate — it’s that easy. Now, some lucky kid in Germany can hover around with all their friends ... or whatever it is you do on hoverboards.

History of Blockchain

Before we dive into exactly how blockchain makes this possible, let’s talk about the history of blockchain. In October 2008, the secretive founder of bitcoin Satoshi Nakamoto introduced the world to peer-to-peer electronic payments. His cryptocurrency formed the world’s first blockchain. Because bitcoin’s software is open source, allowing anyone to see, reuse, and adapt the code behind it, it didn’t take long before users started modifying it for different purposes.

Early on, blockchain users mostly tried to make better versions of bitcoin. Litecoin, an alternative cryptocurrency developed by a former Google employee, aimed to provide faster transactions. Others, like the meme-inspired Dogecoin, were created for people turned off by bitcoin’s high price point.

Namecoin.org developed one of the first uses of blockchain for something other than cryptocurrencies. The technology uses blockchain to register .bit domain names as an alternative to the primary domain name management system. Namecoin makes it extremely difficult for external players, like the government, to take control of websites. Because .bit domains get registered in a blockchain, they are nearly impossible to change without knowing the encryption key.

The next significant innovation came in 2013 when a small startup named Ethereum put out a paper outlining a way for developers to easily create entirely new blockchains without relying on bitcoin’s original code. Two years later, Ethereum launched their new platform, allowing users to expand blockchain’s functionality beyond cryptocurrencies.

Currently, companies and individuals are exploring how to use blockchain technology in healthcare, energy, supply chain management, and many other industries. But more on that later.

How Does Blockchain Work?

Although there are different ways to set up a blockchain, Harvard Business Review laid out five principles that all blockchains have in common. Firstly, all blockchains use a distributed database — this means that every user in a blockchain can access the complete database, including its past transaction history. This transparency allows users to verify any information they need and to complete transactions directly, without any intermediaries.

Secondly, any transactions or communications get conducted between peers. Each user stores records and sends information directly to all other parties in a blockchain. Because of this technology, intermediaries and central storage institutions, like banks, are unnecessary. Users have all the information they need to vet other users, otherwise known as nodes.

Third, although blockchains are transparent, each user associated with a blockchain can remain anonymous. To protect users' identities, each user has their own unique “30-plus-character alphanumeric address” that they use in place of a name. Users can choose to share their identity or remain anonymous with their blockchain address.

The alphanumeric addresses are also used to verify transactions. You may have heard the term “mining” associated with bitcoin. When someone “mines” bitcoin they aren’t digging around in the earth in search of a bitcoin filled hard drive … except for that one time. Rather, here’s how mining actually works: When someone wants to make a transaction, and therefore add new record or “block” to the ledger, they first need to solve what is essentially a math problem. Computers use their computing power to “mine” for the answer, which is vetted by the network of users. If the answer is correct, the new block is added to the ledger. A token, also known as a coin, is generated when this occurs —almost like a receipt to prove it happened.

Fourth, because blockchain uses a digital ledger, the entire transactional process can be automated using algorithms. For example, when you buy a house, you pay for a lot of other small costs like title registration, mortgage lenders, inspections, and legal fees. There are all these other people involved to provide access, regulate, and administer a sale from one person to another. But a lot of this complexity disappears with blockchain. You can record property data and even build in digital rules — called smart contracts — that, once fulfilled, allow the system to automatically transfer a property title or money for purchase.

The fifth characteristic of blockchain is that, once a record gets created, it cannot change. When miners verify a transaction, that record is shared with every other party in the blockchain as part of the decentralized ledger. Part of each verified transaction is also used to generate the math puzzle for the next block in the chain. This means each transaction gets linked to the ones that came before it and all those transactions get stored across multiple computers with no single point of failure.

Blockchains can also be public or private. Both types of networks share the five characteristics listed here but have one major difference. A public blockchain is open to the general public and anyone can join, execute and verify transactions, and everyone maintains a copy of the decentralized ledger. The bitcoin blockchain is currently one of the largest examples of a public blockchain network. In a private blockchain, participation is limited to users who receive an invitation to join the network and are granted permission to enter. Think of it like the early days of Facebook when users needed email addresses from certain schools. Aside from the increased security offered by private blockchains, they are also much more cost efficient since much less computing power is required to verify transactions in a smaller network.

Still confused? I don't blame you. Here are some talking points on how blockchain works for your next cocktail party.

- Blockchains are completely transparent. Any user can view any transaction from now until the end of time.

- All transactions get completed between individual users. Say goodbye to intermediaries.

- Even though blockchains are transparent, a user’s identity doesn’t have to be. All users are assigned a public address to use in place of a name during transactions.

- Because blockchains live online, we can use algorithms to automate future transactions — just like you automatically pay your Netflix subscription every month.

- Once a block gets added to a blockchain, it’s there forever — no ifs, ands, or buts.

Got it? Let’s move on.

Benefits of Blockchain

If you’ve stuck with me this far, congratulations are in order! Blockchainis complicated stuff. You may be thinking, if blockchain is basically just a new way to organize records, why are people so excited about it? Don’t worry! This is the part of the article where we talk about the benefits of blockchain and how it has the potential to change the world.

Blockchain Security

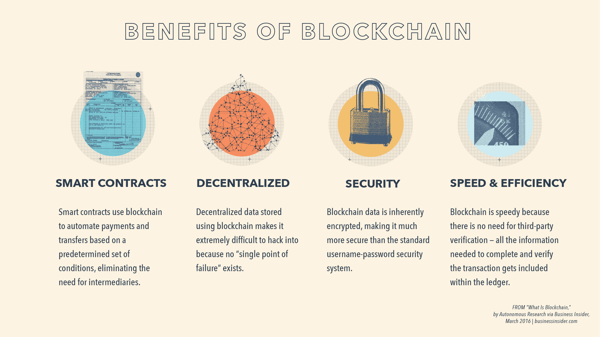

One of the largest benefits of blockchain is its ultra-secure network. Because data transmitted using blockchain is inherently encrypted, it’s much more secure than the standard username-password security system. However, the real security benefits come from blockchain's network of users.

Decentralized data stored using blockchain makes it extremely difficult to hack into because no “single point of failure” exists. What does all this mean? Let’s say you have all your documents backed up on a single hard drive. If that hard drive is lost, stolen, or destroyed, all of your documents are gone … forever. But if all your documents are saved on thousands of different hard drives, it’s unlikely that you’ll ever lose your data. That’s the power of blockchain security.

Under usual circumstances, to break into a blockchain, hackers would need to overwhelm over 50% of the network in less time than it takes to create a new block. The amount of computing power required to do this in most blockchain networks is tremendous. Larger networks are much harder to hack because they are more decentralized and have more computers working to verify transactions.

And it’s easy to detect when a block has been tampered with thanks to hash functions. Hashes from one block are added to the data in the next block. Anyone who tries to alter a block will end up changing the hash completely, setting off a red flag and disabling the block completely.

Blockchain also offers anonymity. Without blockchain, systems use a variety of information like names, addresses, card numbers, and social security numbers to verify transactions. All this personal information is vulnerable to being stolen. In a blockchain, only the private key matters.

Each blockchain user has two keys: a public key and a private key. Their public key is derived from their private key using a mathematical formula and then combined with other information to form their public address for transactions. Without the private key, it is impossible to verify transactions to the public address. This private key never gets shared with outsiders which means multiple complex formulas stand between a user's private key and their public address.

You may be wondering if it's possible to reverse the formula and uncover someone's private key from their public key? The bad news is that it is possible. The good news is it would take the world's most powerful computer 40,000,000,000,000,000,000,000,000,000,000 (I don’t even know how to pronounce this number) years to figure it out. That’s way longer than the universe has even existed ... so I wouldn’t worry about it.

Decentralization and Smart Contracts

The second benefit of blockchain comes from decentralization and smart contracts. Presently, smart contracts may represent the most powerful application for blockchain.

HubSpot’s Director of Acquisition and resident blockchain expert Matthew Howells-Barby states: “One of the more immediate ways in which blockchain technology is going to impact SMBs is through smart contracts. Smart contracts facilitate the creation of trustless digital contracts that can be used for all kinds of application - something that has never been possible before without a third party being involved. Imagine being able to create digital contracts with contractors that would automatically pay them once work has been completed to a satisfactory standard. This is one of the many applications that smart contracts offer."

Essentially, smart contracts use blockchain to automate payments and transfers based on a predetermined set of conditions. Using smart contracts, you could automatically pay your electric bill once your electricity usage hits a certain amount. The transaction would be sent securely to the power company and verified using blockchain. No more late fees, no more stolen financial information — you would never have to think about scheduling a payment again.

Once again, as more and more transactions are automated using smart contracts, the need for middlemen and outside organizations will diminish. Because information gets distributed across the entire network, it's extremely difficult for one group to seize control of it. Governments and individuals in positions of power will no longer be able to shut down sources they wish to repress because the information will exist on many computers across the network.

Speed and Efficiency

Third, blockchain is fast and efficient. Manual data entry is tedious and prone to error. Think about it. How many typos do you typically make writing an email? Most organizations maintain multiple record systems for different tasks. For example, an ice cream store may use one record to track the amount of ice cream and supplies they purchase, another to track hours their employees work, and another to track sales. Reviewing separate records takes up a lot of time. With blockchain, all this information gets stored and verified as it gets generated.

Blockchain's verification speed has vast benefits. For example, a simple stock purchase can take up to a week to verify using current methods. Several forms, organizations, and a ridiculous amount of acronyms are involved in the process. With blockchain, there is no need for third-party verification because all the information needed to complete and verify the transaction gets included in the ledger. That means stock transfers can happen almost instantaneously instead of a full week later. Talk about some serious returns!

Applications of Blockchain

Okay, so we’ve talked about what blockchain is, how it works, and the benefits of using it, but is anyone actually using this technology? Like really using it ... not just for trying to get bitcoin rich? The answer is an enthusiastic yes!

According to Financial Times reporter Sally Davies, “[Blockchain] is to bitcoin, what the internet is to email. A big electronic system, on top of which you can build applications. Currency is just one.”

In simple terms, bitcoin is only one, tiny application supported by blockchain — there are endless possibilities for the technology. Let’s do a deeper dive on some other applications of blockchain.

FinTech

Payments and Cryptocurrencies

Let’s just get this out of the way — cryptocurrencies are indeed one of the most popular blockchain applications. I know, I know, I said I was going to talk about other applications of blockchain. I promise I will, but it’s impossible to talk about blockchain without taking a look at the application it was originally built for — bitcoin.

Partially because it was the first one and partially because it has the largest network of users, bitcoin is the most valuable cryptocurrency based on U.S. dollars. In fact, bitcoin has become so popular that stores, restaurants, and even bars are starting to accept it as payment. In larger cities like New York, you can live your life only paying in bitcoin, though it isn’t always the most practical approach. Bitcoin has also been used to cope with hyperinflation in Venezuela, as payment for online gambling, and for market speculation.

Because bitcoins trade on an open market, investors like the Winklevoss twins were able to make bets on future price movements. It's impossible to know for sure, but it's estimated that there were over 20,000 bitcoin millionaires at the start of 2018. But before you go investing in bitcoin, don't forget that the cryptocurrency is also infamous for its massive price swings. Many lost fortunes speculating on the currency to the tune of $86.7 billion this year alone.

Other cryptocurrencies like Ripple, Litecoin, and Ethereum can also be used to send payments or for market speculation, but these cryptocurrencies have their quirks. Ripple is positioned to speed up international transactions and reduce transaction fees. The four seconds it takes Ripple to settle a transaction is faster than any other cryptocurrency and significantly faster than the expensive, multi-day process currently in use by most banks. For this reason, companies like American Express and Santander Bank have started experimenting with Ripple for international transactions.

Litecoin is also useful for payments but is focused more on the everyday stuff than on purchases across borders. According to its founder Charlie Lee, “Litecoin is targeted more towards payments, faster transactions, and lower fees.”

The supply of Litecoins is four times larger than bitcoin and transactions also occur four times faster.

Then there’s Ethereum and its cryptocurrency Ether. The smart contracts built into Ethereum’s code allow for a wide range of deals to occur automatically once pre-negotiated terms get met. This is a major stepping stone for using blockchain in industries outside of FinTech.

Trade

These cryptocurrencies and, more importantly, the blockchain behind them will have a tremendous impact on trade. Faster verification times, reduction or removal of exchange fees, and elimination of errors will make domestic and international trade easier than ever before. By implementing blockchain within their internal financing unit, IBM was able to free up $100 million previously tied up in disputes. Imagine how much more could get done by using blockchain for the trillions of dollars in transactions that occur every day in the U.S. financial system alone.

Crowdfunding

Outside the worlds of insurance and international trade, blockchain will also create massive changes in the way businesses and startups raise capital. Sites like Kickstarter, founded in 2009, democratized fundraising by allowing just about anyone to find financial backing from a broad audience instead of traditional sources like banks and venture capital funds. There's also a built-in insurance policy since payment only gets collected for projects that meet their funding goal. For this service and for connecting entrepreneurs to potential funders, Kickstarter charges a 5% fee. To date, the platform has raised over $3.4 billion in funds for various projects.

With blockchain, these fees get eliminated since a network allows for immediate verification and smart contracts allow transactions to take place only once a project is fully funded. Some artists and startups are already experimenting with blockchain crowdfunding in the form of ICOs or initial coin offerings. The virtual coins function the same way as bitcoin, and investors purchase these coins like shares of stock to invest in the business that offers them. However, unlike in the stock market, purchasing these coins does not mean a user purchased ownership rights — this makes ICOs an extremely risky investment.

Property and Identity

There are few things more important than protecting your identity and property records. Birth, marriage, and death certificates allow you to claim a variety of different rights, including citizenship, employment rights, and voting rights. Pretty important stuff, right?

But in many countries, personal and government records still exist only on paper. During the 2010 earthquake in Haiti, most of the country’s paper land registry files were destroyed, so there’s no way to know who owns what. This has opened the door for corruption and further loss. In the future, blockchain will provide stability during uncertainty.

In addition to being a digital fail-safe for important documents, blockchain is also an extremely secure identity management system. Think about how often you provide personal or financial information over the internet. Once a week? Once a day? Two hours ago when you bought those new boots during your lunch break? Hey, no judgment – I'm just looking out for your financial security.

Being able to accurately verify your identity is essential to all online transactions, but the data you provide can be vulnerable to attacks. Blockchain’s decentralized ledger and unique user addresses make it difficult for hackers to obtain your sensitive information.

Supply Chain

Thanks to smart contracts, many retailers are using blockchain to help simplify their supply chain processes. In early 2017, Maersk, one of the world’s largest container shipment operators, joined forces with IBM to create a digital blockchain-based supply chain system. The goal: To create a faster and more secure and cost-effective way to trade goods internationally. IBM stated, "The costs associated with trade documentation processing and administration are estimated to be up to one-fifth the actual physical transportation costs. A single vessel can carry thousands of shipments, and on top of the costs to move the paperwork, the documentation to support it can be delayed, lost or misplaced, leading to further complications.” Talk about a logistical nightmare.

With blockchain, all parties involved in the supply chain can access any necessary documents and view transportation events in real time. All of the supply chain information is accurate and secure because no individual party can alter the blockchain without permission from others in the network. This transparency helps reduce shipment time, money, fraud, and errors — getting consumers the goods they need from around the world.

Healthcare

Healthcare – yeah, it’s complicated. It’s so complicated and confusing that I often find myself skipping the doctors just to avoid the massive amount of paperwork and stress that comes along with visiting the office. Don’t look at the screen like that – I know you’ve done it too.

Thankfully, blockchain is here to save the day, aka our lives, or at least make them easier. Blockchain technology allows patients, insurers, and physicians to view and update medical records in a secure and timely fashion. This access to data can also help doctors recognize early indicators of disease or weakening health. According to a study from IBM, “healthcare organizations are moving fast and even seem to have a lead on the financial industry.”

Beyond just, you know, saving lives, blockchain can also help in other areas like reducing Medicare fraud, which cost over $30 million in 2016 and centralizing information from wide-reaching medical studies into a comprehensive database. Blockchain even makes it possible to pay for procedures based on outcomes instead of predetermined rates. In fact, Robomed Network is already using blockchain to do this for over 9,000 patients.

Energy

Once energy enters into an electric grid, it’s impossible to tell if it got generated by a fossil fuel plant, nuclear power, or a renewable energy plant. To track the amount of energy coming from renewable sources, power plants use a complex, expensive system.

Cutting out intermediaries, reducing errors, and building a decentralized record for the sources of renewable energy with blockchain would remove many of these barriers. But it doesn’t end there. Over the last several years, a new distributed grid has grown in size. This grid is comprised of solar panels on the roofs of homes and batteries from electric cars. When these systems produce more energy than they need, their owners can sell the excess power back to the power company, but it can take several months to see returns. LO3 Energy has begun experimenting with a blockchain powered microgrid in Brooklyn that lets users sell their excess energy to their neighbors. Because it’s easier to distribute electricity locally than to send it over long distances, decentralized blockchain microgrids could help prevent power outages and maximize energy use from distributed producers.

Investing in Blockchain

By now you're probably thinking one of two things: Wow, blockchain is going to change my life or … I still don't get it. That's okay! I've said it before and I'll say it again, blockchain is a tough topic to grasp, and it'll likely be many years before the technology is widely adopted. Small- and medium-sized businesses should wait for blockchain technology to mature before worrying about how to adopt. However, there are some ways they can start experimenting with blockchain applications. In this section, we'll walk through how businesses can start investing in blockchain in a smart, deliberate way.

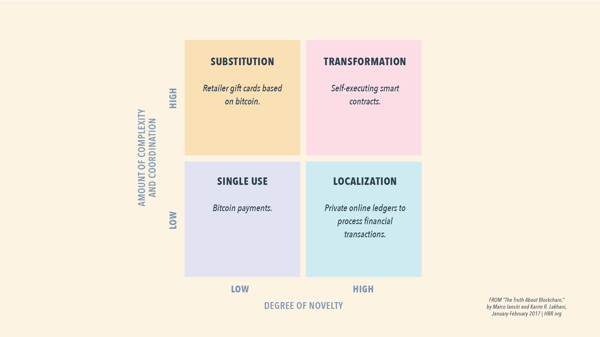

According to Harvard Business Review, there are two factors to consider when thinking about how quickly new technology will impact a business: novelty and complexity. Novelty represents users' familiarity with the application. The more novel or unfamiliar the technology is, the longer it'll take to become commonplace. Complexity is the number of people needed to adopt an application for it to have impact. For example, a dating app is useless unless a lot of people create profiles. How annoying would it be to swipe left on on Chad 17 times before coming across an intriguing profile?

These two criteria help inform executives of the roadblocks they might face and the effort needed to implement a specific blockchain application. Take a look at the chart above. Businesses that are looking for a low barrier to entry should consider implementing single-use cases of blockchain. Single-use cases have a low degree of novelty and complexity. So what exactly is a single-use case? Accepting bitcoin payments. HBR states, “... bitcoin is growing fast and increasingly important in contexts such as instant payments and foreign currency and asset trading, where the present financial system has limitations.” Accepting cryptocurrencies as a form of payment makes it easier for customers all over the world to quickly and securely purchase your products.

If you start accepting bitcoin as alternative payment, your business could then start experimenting with a blockchain application that is increasingly novel but still has a low level of complexity — a private blockchain ledger to record all transactions. Once you have a good handle on these more simple applications, consider using more complex blockchain applications like smart contracts. The possibilities for how blockchain can help improve business processes are endless — it’s just a matter of how much effort and money you want to invest in an application right away.

Conclusion: The Future of Blockchain

That was a lot. And it’s okay if you don’t understand all of the intricacies of blockchain or aren’t ready to start incorporating it into your business strategy just yet. It’ll take many years and buy-in from numerous different industries before blockchain becomes commonplace. And while we don’t recommend SMBs worry too much about blockchain just yet, it’s important to keep an eye on the emerging tech as larger enterprise businesses start developing more blockchain applications.

So the next time you find yourself sinking into a deep hole of depression because you didn’t scoop up bitcoin while the iron was hot, remember the most rewarding technology — blockchain — is still to reach its full potential.

from Marketing https://ift.tt/2FYo3fI

via

No comments:

Post a Comment