You've heard the term "break even." It's a popular way to describe a time when you spent exactly as much money as you made. "We gambled $200 at the casino and won $200, so we broke even."

But in a business context, it's not that simple.

Your break even point doesn't just happen in Vegas, and needs to be constantly recalculated for you to turn a profit in the long term. Here's how to find it.

Find Your Contribution Margin

Recently, I explained how a business calculates its contribution margin -- the amount (ideally in the form of a percentage) that your revenue from sales exceeds your variable costs to develop the product. There are two reasons you should care about this figure.

First, your contribution margin deliberately leaves out your operating costs so you can see exactly how profitable your product is. For example, while software and website costs to an ecommerce clothing business don't directly contribute to the business's product (the clothing), the cost its thread vendor charges does. The business omits the first cost because it only wants to see how profitable its clothing is against what it pays to produce it.

The second reason contribution margin is so important? You need it to calculate your break even point.

Although operating costs are irrelevant when assessing a product's profitability, they're critical when assessing your business's profitability. These costs, also called fixed costs, factor back into your books when calculating your profit margin -- your total profitability after all business expenses paid. And in order to achieve a high profit margin, you first need to know when you'll break even.

Break Even Point

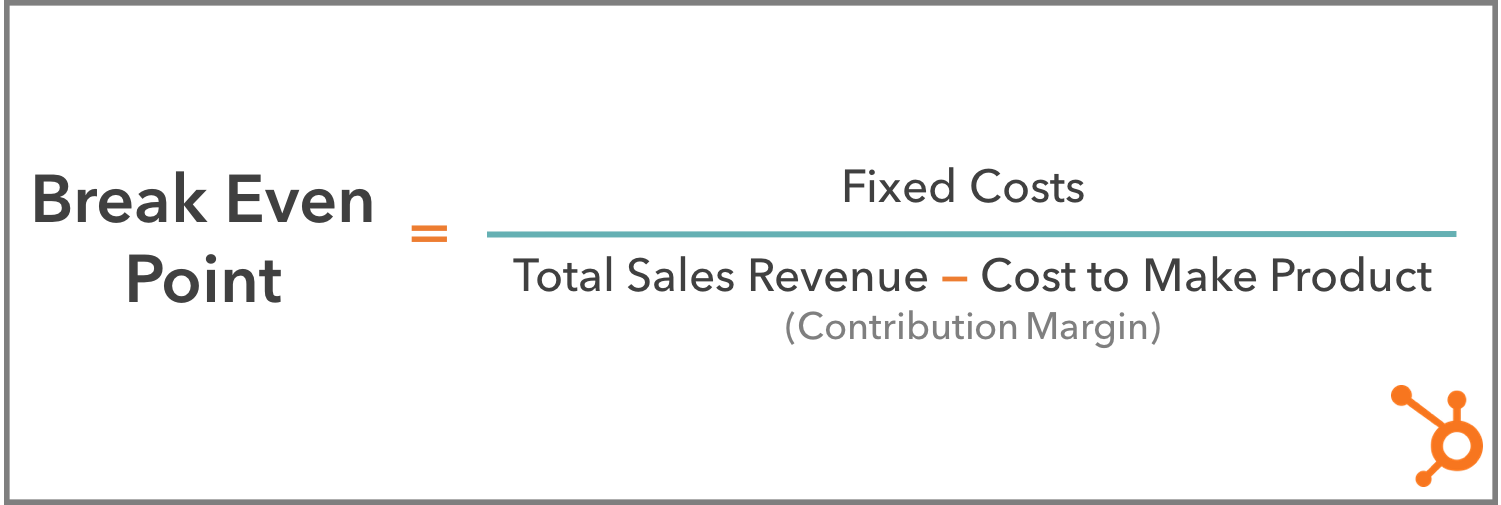

A business's break even point indicates when total revenue from sales will be equal to total costs to the business. As a formula, your break even point is your fixed costs divided by your contribution margin, and the final number can be used as a recurring metric by the business to predict profitability.

Keep in mind that a break even point isn't a finish line. Breaking even is an exciting milestone for a growing business, but the break even point indicates when the business's revenue will be equal to its costs -- not when it is. Businesses run the equation described above multiple times a year, eventually surpassing their break even point and (hopefully) becoming profitable.

So why is this number recalculated all the time? Once you "break even," aren't you officially on the road to profitability? Yes and no. If you were to calculate your break even point according to yearly revenue, yearly fixed costs, and yearly contribution margin, then yes, you'd get a number that is more representative of the business's profitability since you're considering a full year of activity. And once you break even, you wouldn't have to track your break even point as often.

But there are shorter-term break even points that reset on a weekly, monthly, or quarterly basis to guide you as you strive to reach your end-of-year (EOY) break even point.

For example, if fixed costs such as your monthly office rent total $3000, and your product has a contribution margin of $250 per unit, you'd have to sell 12 units of your product by the end of the month to break even for that month. See how I came up with this number below:

The following month, you're back to square one, as you're on the hook for $3000 worth of bills for next month and need to sell another 12 products to, once again, break even for that period of time.

Set Goals to Become Profitable

Luckily, as a business grows, it won't have to meet these incremental break even points in order to declare itself profitable by EOY. The business's monthly revenue can even come up short of a month's fixed costs, but break even or declare the business profitable at the end of the year.

How? With seasonal fluctuations in sales, you might fall short one month but become super busy during a holiday and make up for it. Perhaps you host a flash sale that reduces revenue in the short term but develops brand loyalty that brings in long-term customers, and a more steady revenue stream. Just be sure you calculate your break even point first before running a sale or discount so you can set appropriate goals for the sale itself. Houston, we have a profit.

Now it's time for you to calculate your business's break even point … How'd you do? Did you plug your sales figures into the formula above and get a scary number? Don't sweat it -- that's why these incremental break even points are so helpful to a growing business.

If you're discouraged by how much work you'd have to do to break even by the end of the year, shorten the time period of your break even point. By setting a goal to break even every week or month right now, you can set yourself up to break even after larger stretches of time later.

from Marketing https://ift.tt/2HKsBVz

via

No comments:

Post a Comment