The economic impact of COVID-19 is undeniable. Businesses all across the globe are learning how to adapt to these new circumstances and we're all learning how to operate in a "new normal" that's constantly changing.

That's why we'll be publishing week-over-week trend data for core business metrics like website traffic, email send and open rates, sales engagements, close rates and more. We hope to establish useful benchmarks to measure your business against, and serve as an early indicator of when short- or long-term adjustments may be needed in your strategy.

While this post focuses on the highlights of last week, you can explore all the data we're publishing here.

About the Data

- These insights are based on aggregated data from over 70,000 HubSpot customers globally.

- The dataset includes weekly trend data for core business metrics in 2020, focusing on changes occurring during and after March 2020.*

- Charts depict the performance of a given metric against pre-COVID benchmarks, calculated using weekly averages from January 13, 2020, to March 9, 2020. They do not depict week-over-week percentage changes.

- Because the data is sourced from HubSpot's customer base, it reflects benchmarks for companies that have invested in an online presence and use inbound as a key part of their growth strategy.

*The spread of COVID-19 has had a different timeline in different regions, so we are using the World Health Organization's declaration of a global pandemic on March 11, 2020 as our "official" start date.

NOTE: Because the data is aggregated from HubSpot customers' businesses, please keep in mind that individual businesses, including HubSpot's, may differ based on their own markets, customer base, industry, geography, stage, and/or other factors.

What We're Seeing

After several weeks of concerning declines in deals created and deals closed, we are cautiously optimistic about this week's data. While it's certainly too early to call these trends a "rebound," the numbers suggest that companies that had paused "business as usual" in the last seven weeks are beginning to move forward in a new normal.

Last week saw the highest volume of deals closed since the start of the pandemic, even though deals created and closed are still trending below pre-COVID levels. Deal creation increased 8% the week of April 20, compared to the prior week, with increases in every region. Deals closed saw an upward trend as well with a 9% increase the week of April 20.

Buyer engagement reached historic highs last week. Marketing email open rates continue setting new records despite volume of email sends trending far above pre-COVID averages, and the data shows that salespeople are booking more meetings. We saw increases in average contacts added to customer portals as well.

But there's still a major disconnect in how salespeople are prospecting. Thus far, sales teams have struggled to convert buyer interest via email -- send volume is a staggering 67% above pre-COVID averages, and hasn't been accompanied by an equivalent increase in response rates or meetings booked.

However, our deep dive on sales activity suggests that salespeople are starting to book more meetings. With some adjustments to prospecting strategy, we're hopeful that there's opportunity for sales performance to improve.

This week, we're adding two new cuts of data:

- A deep dive on sales activity, highlighting call volume and meetings booked. Weekly average call volume has maintained an approximate 20% decrease from pre-COVID averages, while the volume of meetings booked has rebounded to a level higher than pre-COVID averages.

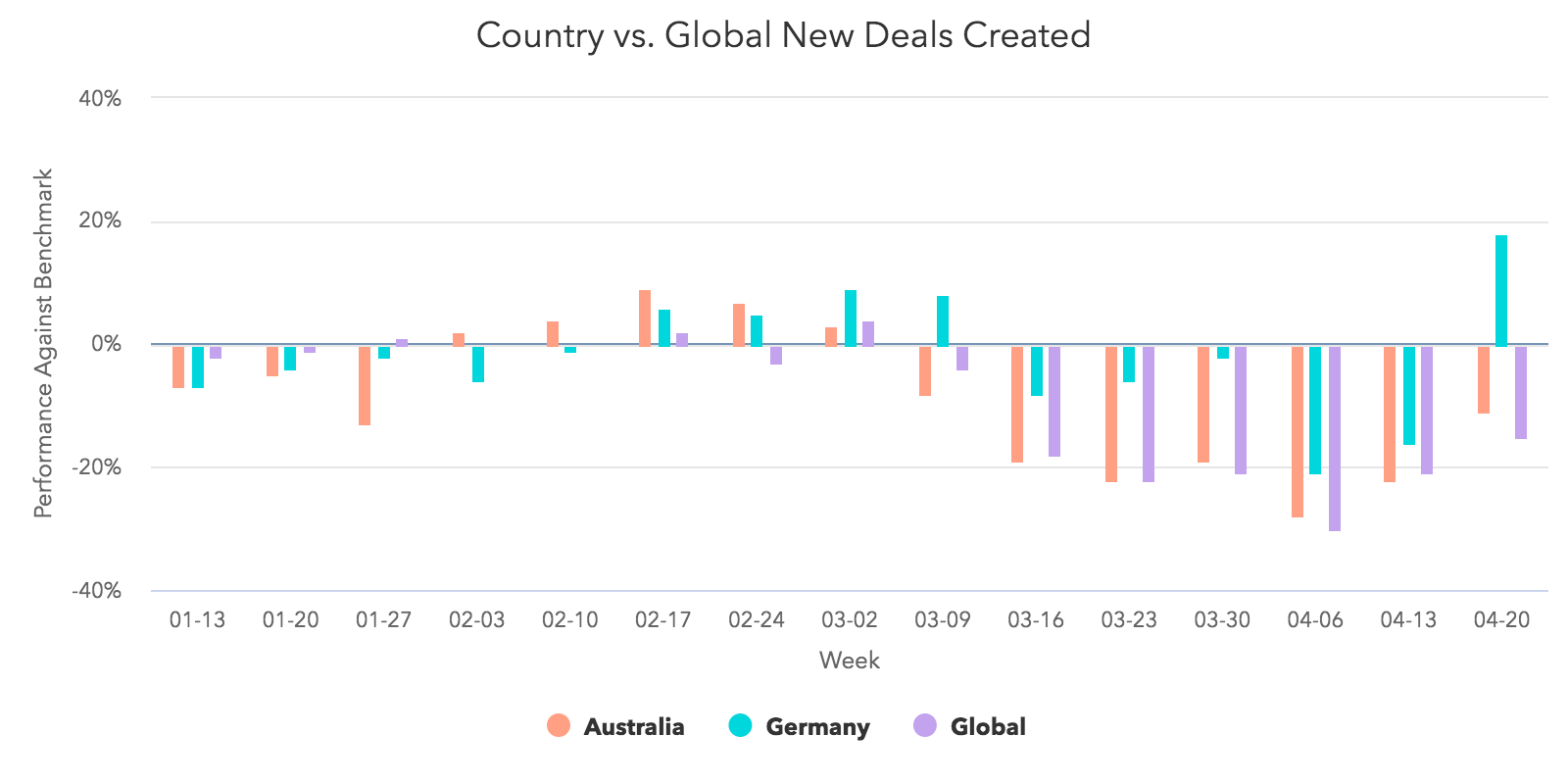

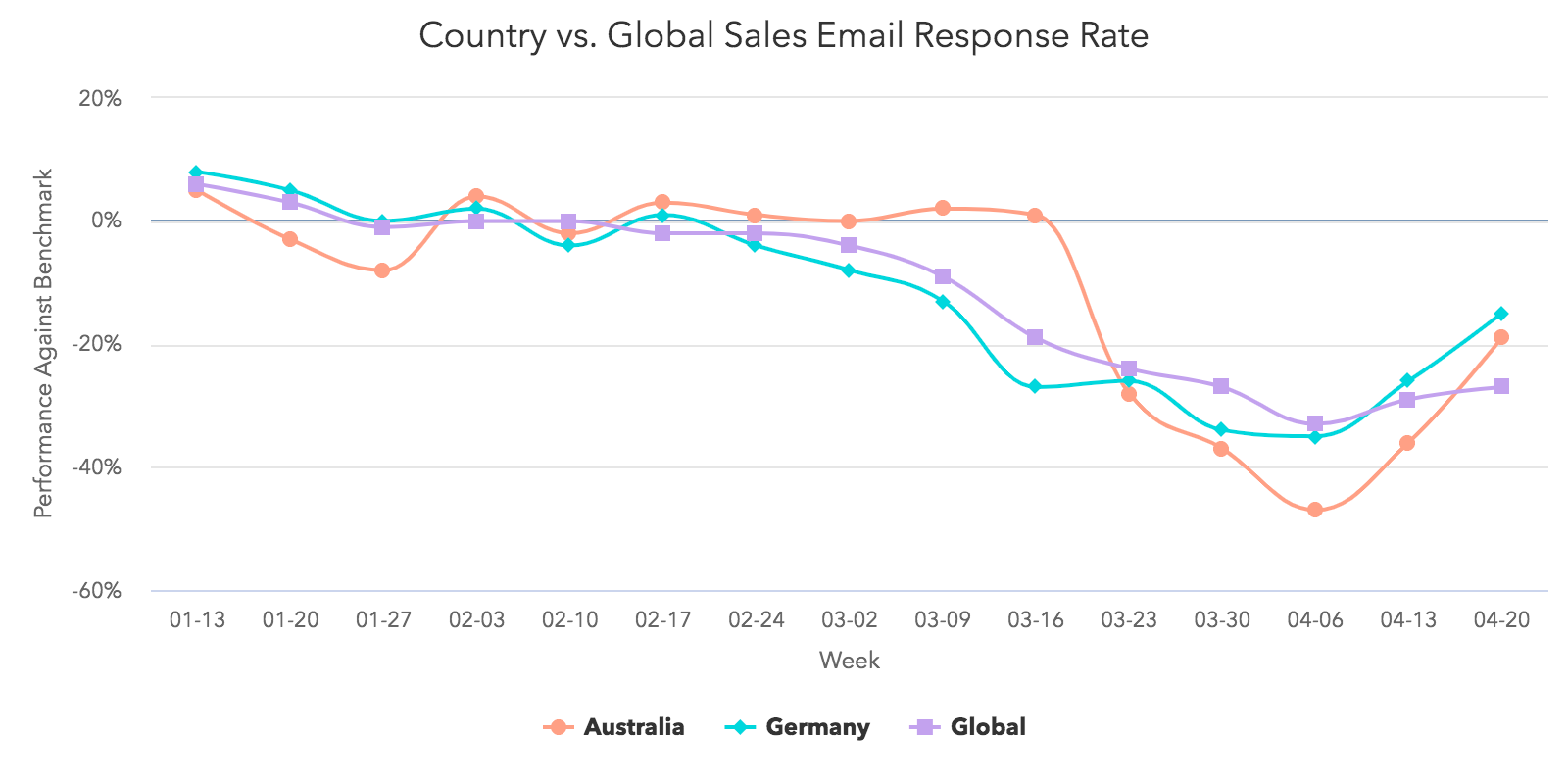

- Country-specific cuts for our core dataset for Australia and Germany. These countries have begun to reopen their economies or have done a good job containing the spread of COVID-19. Over time, we plan to add more countries, and will be watching these granular cuts closely to understand what the early signs of recovery could look like.

There's still work to be done, but last week's movement on these trends is a bright spot. After several weeks of steady declines in these metrics, recent data suggests that buyers are entering a new normal. There's gold in the hills, if sales teams just have the patience to find it -- salespeople would do well to take a breath and rethink their prospecting and outreach now, to ensure they're able to connect with the right buyers at the right time.

How Metrics Changed Last Week

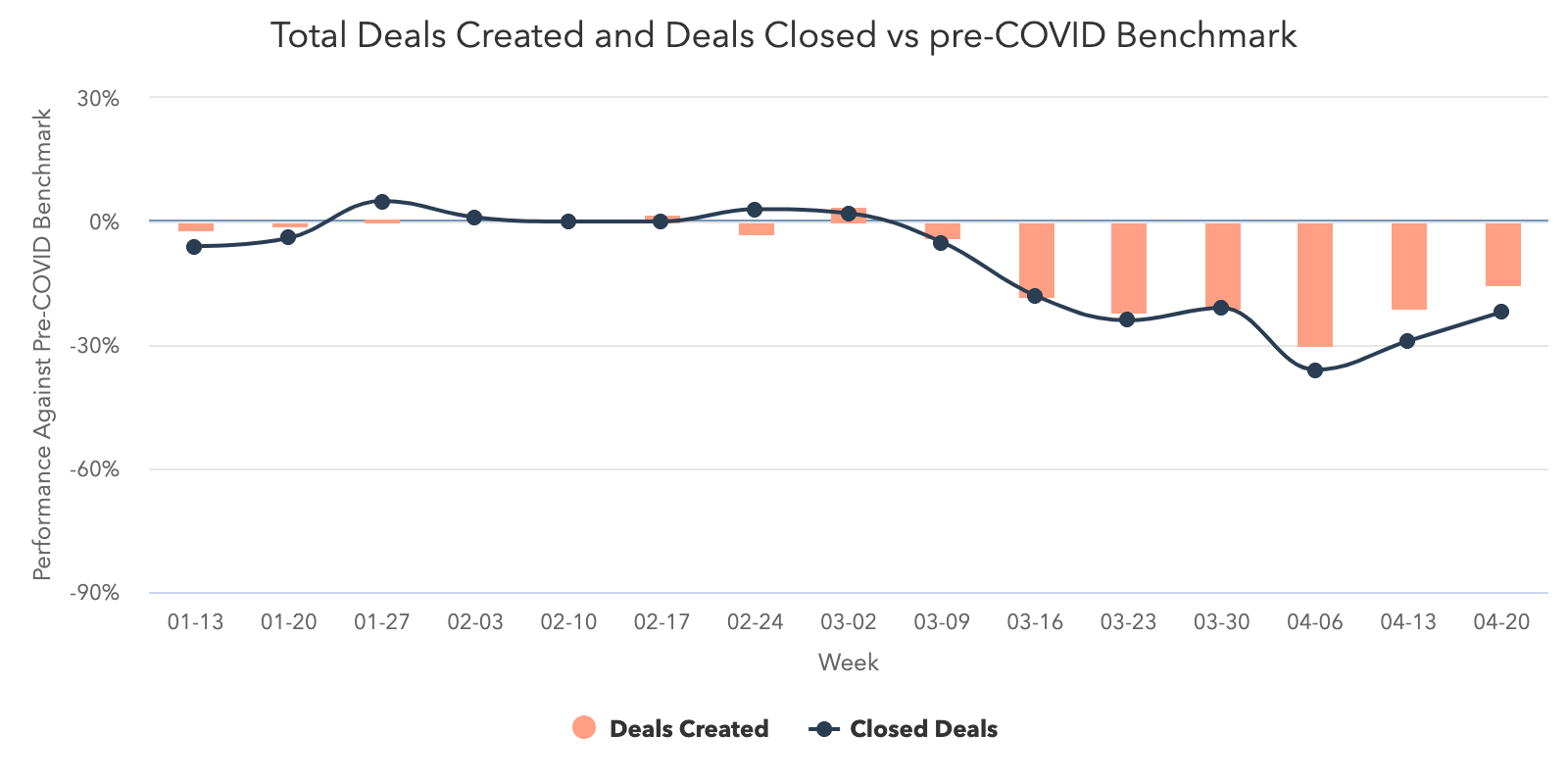

Despite remaining below pre-COVID levels, the volume of created and closed deals is trending in the right direction.

We can't call it a rebound yet, but sales pipeline data from last week revealed the second straight week of growth after sharp declines across all regions and company sizes in March and early April.

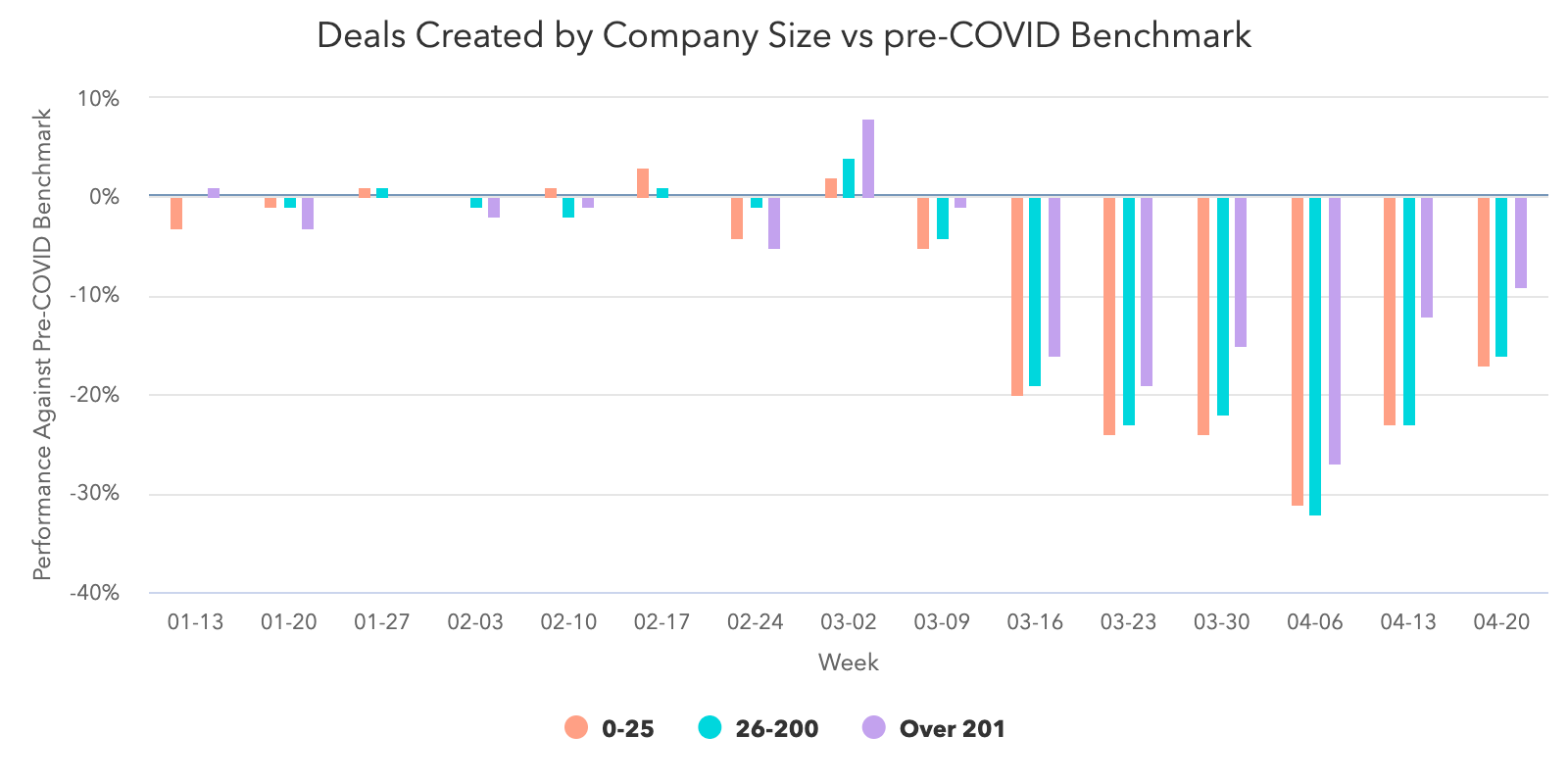

Last week, sales teams created 8% more deals than the week of April 13. This is still trending 15% below pre-COVID levels, but last week was the highest volume of deals created since the start of the pandemic.

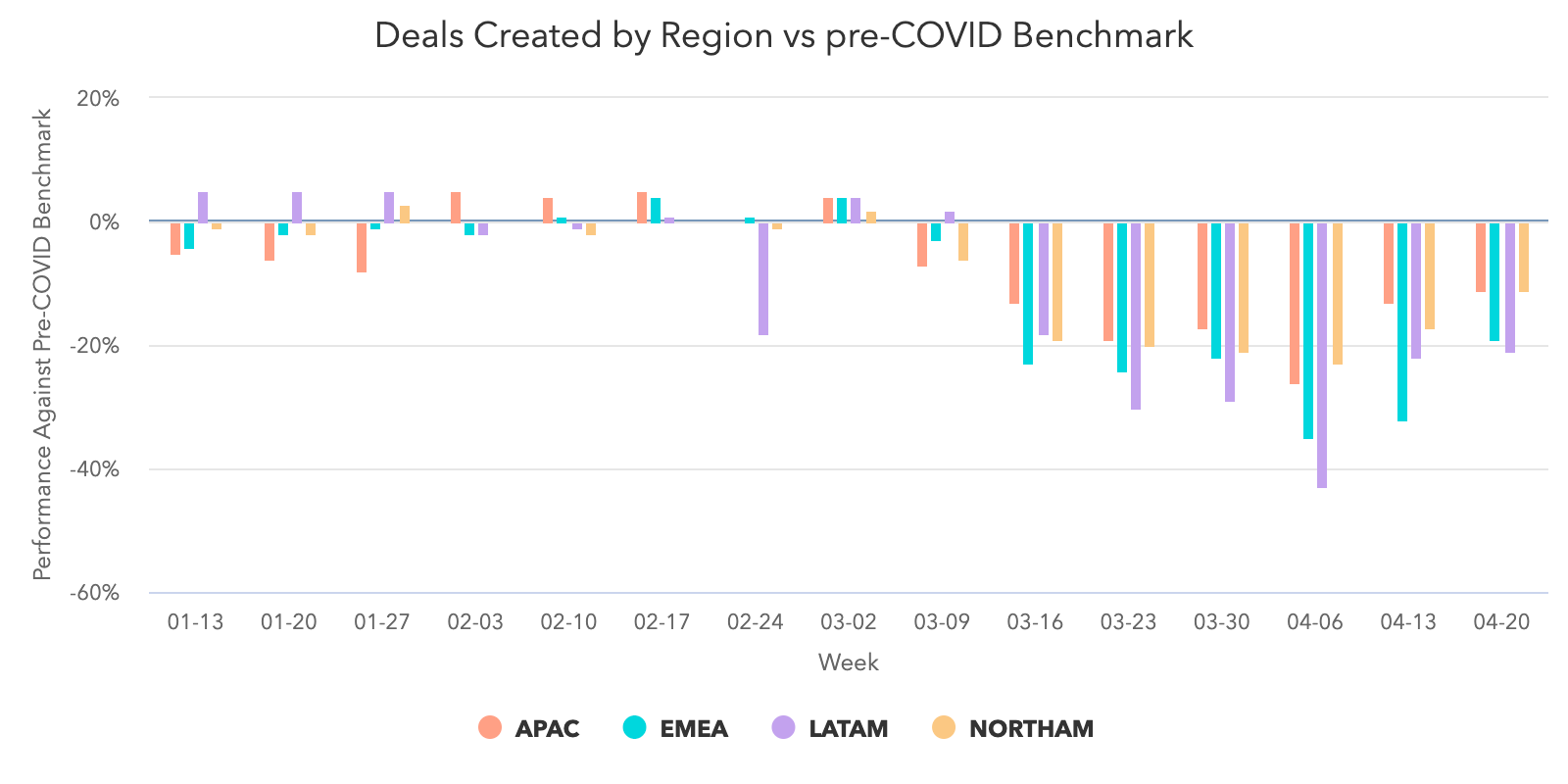

This increase was seen across all regions with EMEA seeing the largest increase week-over-week (18%) and NORTHAM following suit at 7%. APAC and LATAM each saw a small 2% gain.

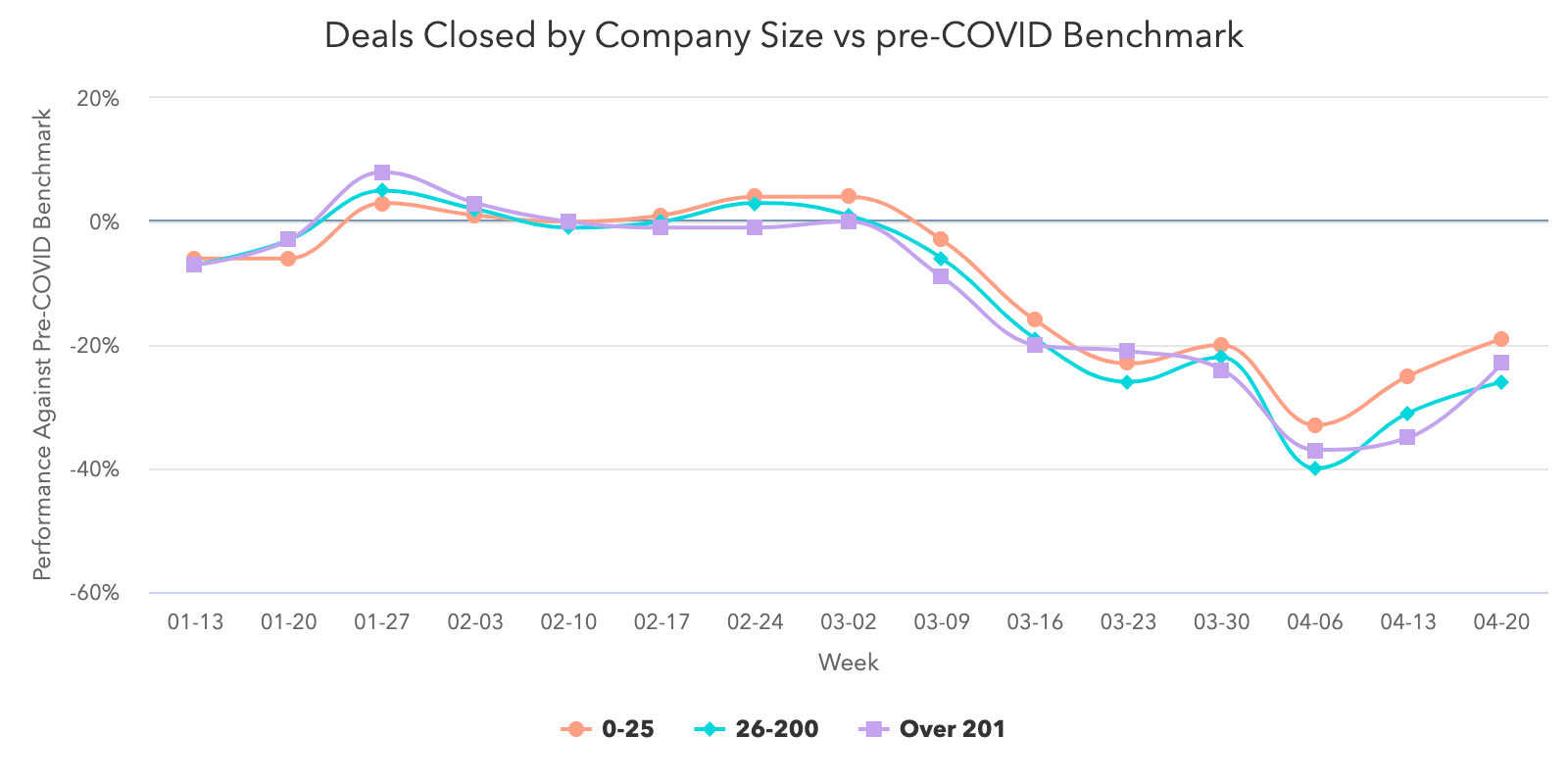

All company sizes followed the same trend. Companies with 201 or more employees are leading the pack with the biggest improvement in performance compared to the start of the pandemic.

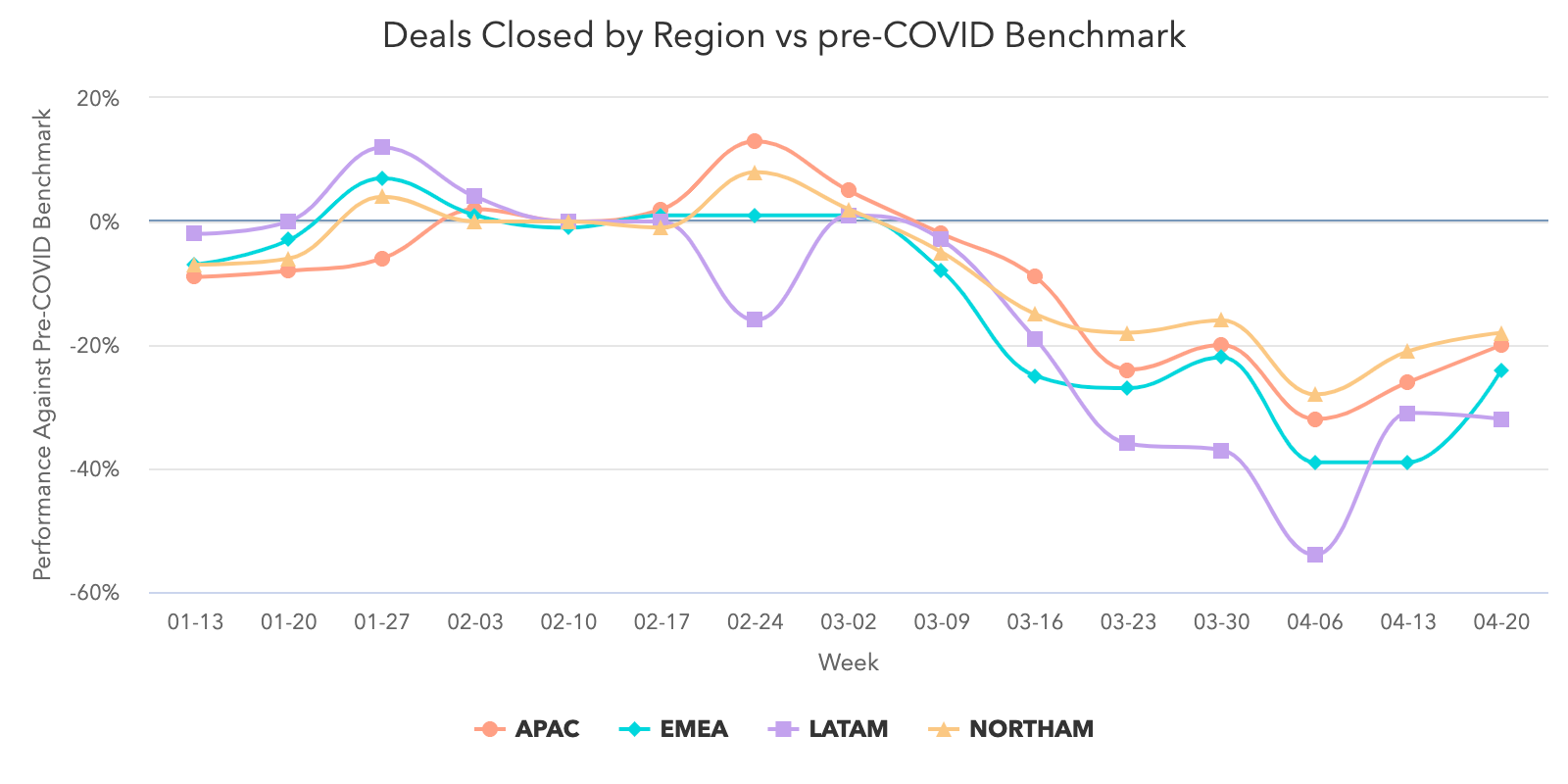

Deals closed improved 9% week-over-week. While the volume of deals closed is still 22% lower than pre-COVID averages, we're encouraged that this metric has improved two weeks in a row.

APAC, EMEA, and NORTHAM followed the global trend. LATAM was the exception to the rule but largely held steady, closing 32% fewer deals than pre-COVID averages the week of April 20, compared to 31% below pre-COVID benchmarks the week of April 13.

Engagement with marketing content reached record levels

Buyers continue engaging with marketing content at levels equal to or higher than pre-COVID averages. Marketing teams that have invested in providing helpful, relevant content, deserve credit for reaching buyers in an incredibly noisy time.

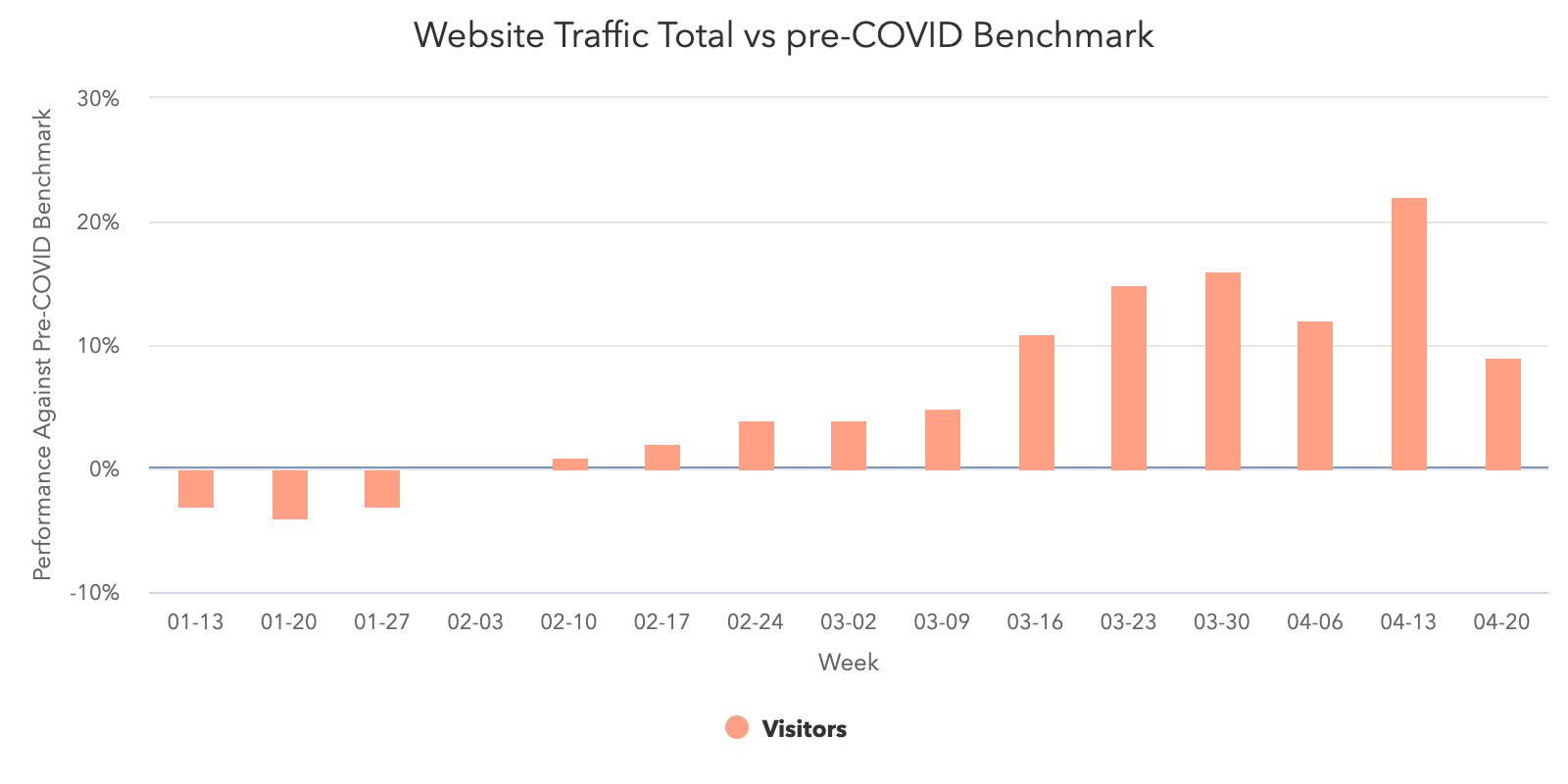

Consumers are still researching and connecting with businesses at high levels. Website traffic increased last week to 24% higher than pre-COVID averages, the highest volume we've seen all year.

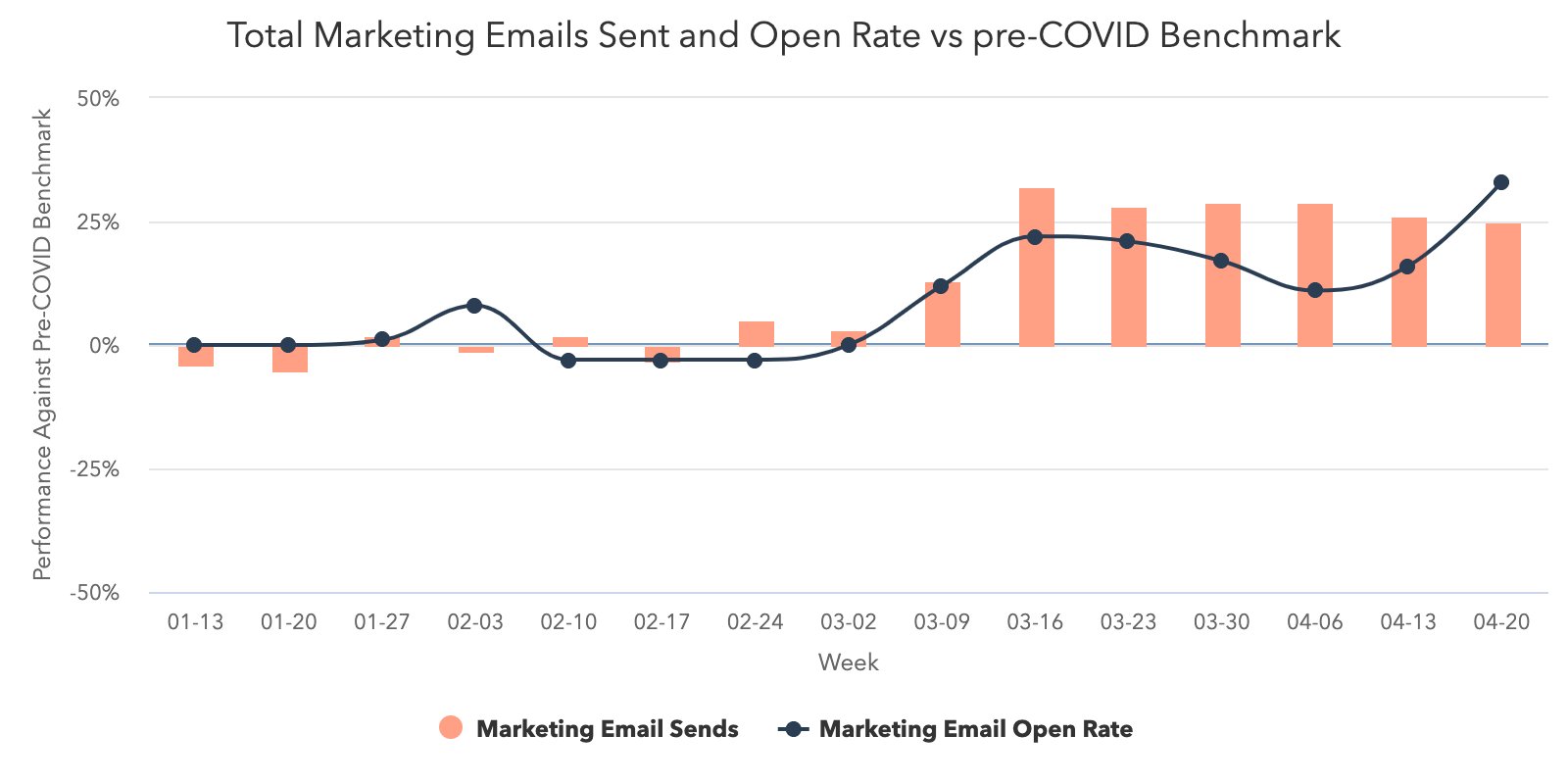

Marketing email volume held steady again, by less than 1% week-over-week, and remains 25% higher than pre-COVID averages. This increase is accompanied by a staggeringly high open rate that is 25% higher than pre-COVID levels, a record for the year.

Engagement with sales outreach is no longer in free fall, but reveals opportunities for improvement.

Sales engagement metrics show slight improvement over the past weeks though they have not recovered to pre-COVID levels. In the coming weeks, sales teams' success will depend on whether they are able to identify and connect with the pool of engaged buyers who have expressed interest in a business' offerings. The data suggests that there's still a significant disconnect between where sales teams are focusing their time, and where buyer interest exists.

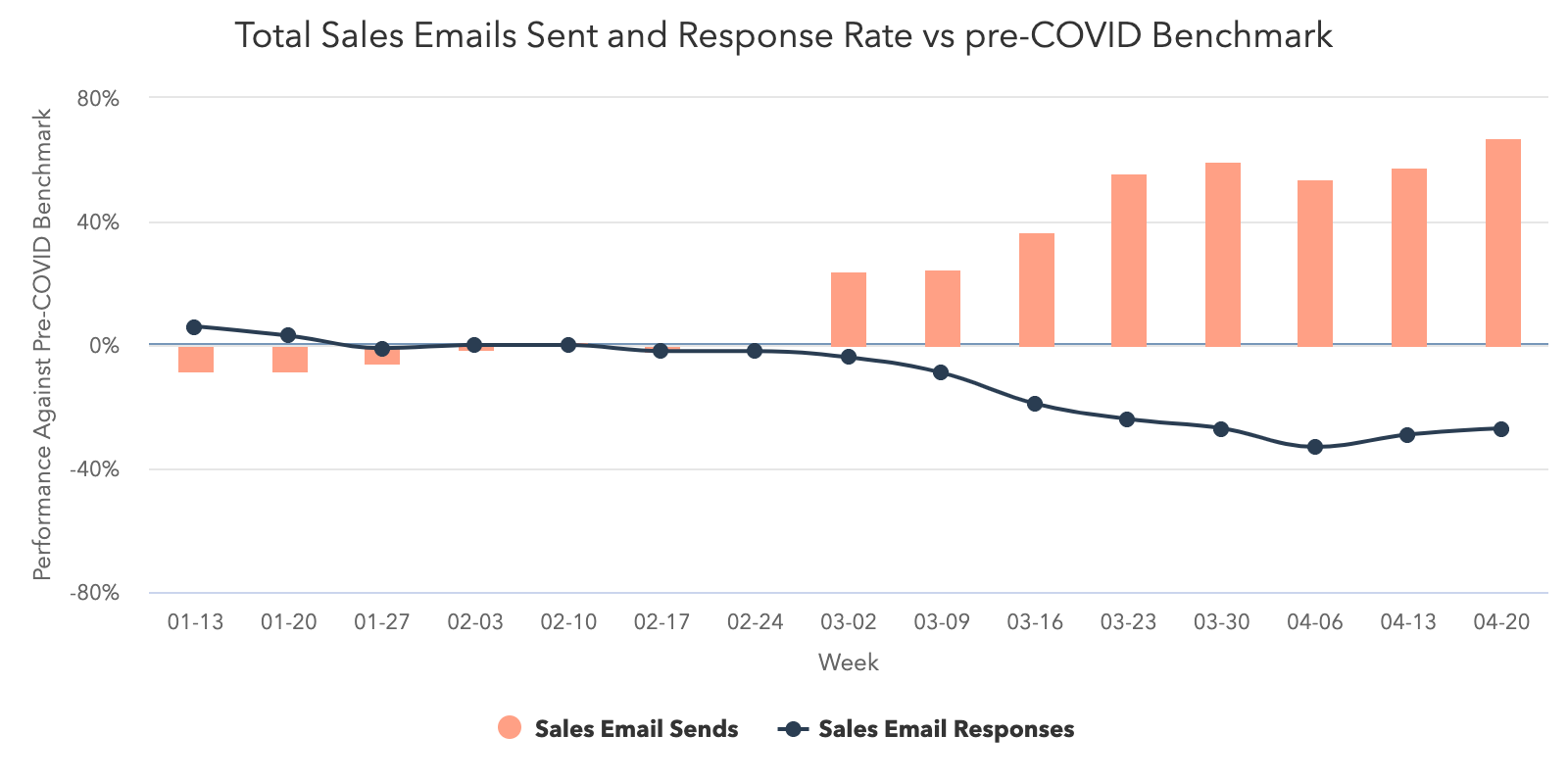

Total sales emails increased by 6% the week of April 20, and are trending at 67% above pre-COVID averages -- the highest level this metric has reached all year. However, after five straight weeks of decline, sales open rates increased marginally, an indication that more total buyers are responding to sales teams this week.

Things get really interesting when we zoom in on two additional parts of the sales process -- call prospecting and meetings booked.

Weekly average call volume has maintained a 20% decrease compared to pre-COVID benchmarks. Sales teams are reallocating time they'd ordinarily use to call prospects toward emailing them in order to reach more buyers, a tactic that will not be sustainable as companies attempt to return to pre-COVID performance.

Encouragingly, another metric appears to be genuinely rebounding. The number of meetings booked was trending at around 7% below pre-COVID averages, but last week increased to 10% above pre-COVID averages. Companies that may have frozen new investments while assessing their financial outlook seem to be reentering the market and restarting stalled deals -- a promising sign. We hope to see this increase reflected in the volume of deals created and booked in the coming weeks.

Countries that have begun to reopen are generally seeing positive movement in the core dataset.

Germany has begun a phased reopening of the economy, starting with allowing some small businesses to reopen on April 20. Australia has been widely praised for containing the spread of the virus, and states have begun relaxing isolation rules for some public spaces and social visit. Both these countries may provide a hint of what the early signs of economic recovery look like.

In Germany, marketing email volume kept with global trends, while open rates dipped slightly last week, though both metrics surpass pre-COVID levels. On the sales side, Germany saw a 14% increase in response rate, a 39% increase in deals created, and an 11% increase in closed-won deals the week of April 20. Germany is creating and closing more deals than the global average, with a higher response rate to sales emails as well.

In Australia, marketing engagement held with global trends as well. Sales email response rates increased 28%, deals created increased 15%, and closed-won deals increased 20% the week of April 20. Australia is creating slightly more deals than the global average, holding with global trends for deals closed, and is also seeing a better open rate than the global average.

We'll be watching these countries (and adding additional cuts) closely to track what economic recovery looks like in countries where the impacts of COVID-19 are starting to lessen. We're hopeful we will see continued improvement in these metrics, and are particularly interested in whether they will settle above or below pre-COVID levels in the coming weeks.

What This Means for Businesses

Transition from outside sales to inside sales.

The last few weeks have doubtless been a time of tremendous change for companies that employ an outside sales model. Temporarily adjusting to an inside sales model is virtually a requirement for businesses hoping to maintain or grow.

In times like these, knowing how to build strong relationships remotely is key. Invest in videoconferencing software to have "face-to-face" conversations online, and build trust by starting conversations with educational content instead of a generic pitch.

Ensure the quality of your sales conversations don't suffer by taking essential parts of the sales process online. If you don't already have a CRMWhether it's training your sales teams on cloud communications so they're able call prospects without physical phones, working with your marketing team to digitize educational content that prospects use to research your products, or learning how to conduct demos online, you'll need to create online equivalents for formerly offline processes. And of course, you'll need the right tools to keep your sales team running -- see below for a dedicated analysis of the technology your team needs.

The last piece of the puzzle is integrating sales enablement with your inside sales engine. Build workflows that ensure the right information is reaching your sales team and that they can easily access it, whether it's through a project management platform, team wiki, etc.

Resources to Help

- Learn to run an online demo with this list of do's and don'ts

- Transition your sales process online with this sales kit

- Learn best practices for sales enablement in this certification

Improve prospecting with targeted, creative outreach.

Our data shows that historic numbers of buyers are visiting and engaging with businesses. Yet we haven't seen a corresponding increase in sales volume. Why?

Part of this decline was inevitable. Companies across the world are tightening their belts and cutting down on nonessential investments. But that can't fully explain historic lows in sales engagement.

The answer lies in prospecting -- the root of most good and bad sales outcomes. The huge increase in email prospecting accompanied by decrease in call volume is both troubling and revealing. Instead of maintaining their standard balance of activities, sales professionals are prioritizing the technique that allows them to touch the largest number of prospects in the least amount of time. Not only has this change had the opposite intended effect, it may also hamstring salespeople who find they've burned through their database by blasting irritating emails to prospects who may have been a good fit down the line.

It's time to get back to basics. Buyer interest is at historic highs, and sales teams that take the time to target buyers who have expressed interest in their products will be better at capturing their interest than teams who are merely emailing as many people as possible.

Encourage your sales team to add a human touch to outreach. For example, recording personalized videos to attach to email messages is a way to stand out in crowded inboxes. Leading with relevance and empathy is more important than ever, and incorporating personalization into your outreach process will drive sales teams to slow down and focus on good-fit prospects.

Resources to Help

- Refresh your email outreach with these sales templates

- Start using video in your sales outreach to engage more prospects

- Lead with empathy in sales emails to build rapport and increase response rates

Remove friction from your sales process with the right technology.

Friction is never good. But in an economic downturn, friction can be deadly. Our data shows that record numbers of buyers are turning to company websites and chat to conduct research. There are a number of ways you can remove friction from your sales process to form more connections between these prospects and your sales team.

Automate and digitize interactions that formerly took place in person. Many steps of the sales process that used to happen face-to-face will need to move online. Chatbots are a useful way to automate parts of the qualification process. Invest in self-service resources like prerecorded demos, and ensure your sales team has the right technology to add a human touch to email outreach, and run sales calls online.

Invest in conversational marketing. Conversational marketing offers a real-time way to answer customer questions and automates the lead routing process so your business can serve prospective and existing customers even when your team is out of the office. Additionally, chatbots can help your company meet the increase in inquiries by providing customers with lightning-fast answers, automating lead qualification, and booking meetings on behalf of your sales and service teams.

Enable self-service. Whether it's through chatbots, online meeting booking, eSigning, or self-service meetings links, implementing technology that allows prospects to engage with your business on their schedule will make the process easier on your prospects and more efficient for your team.

Resources to Help

- Equip your team with these essential inside sales technologies

- Streamline your sales process with this guide to frictionless selling (and this course)

Free Software to Get Started

- HubSpot CRM is free and comes with included sales acceleration tools, including free 1:1 video, meetings, and chatbot tools

- Gmail and Google Calendar integrations with HubSpot

- Zoom integration with HubSpot

- LinkedIn Sales Navigator integration with HubSpot

from Marketing https://ift.tt/3aQ6Y2X

via

No comments:

Post a Comment