Across all industries, it's gotten harder for brands to stand out among the competition. According to a 2020 survey by Crayon, businesses have, on average, 29 competitors — a 16% increase from 2019.

Small and large companies alike are fighting for consumers' attention through targeted marketing campaigns, persuasive sales teams, and competitive pricing structures.

The question is, how can a brand stay competitive as new companies emerge every day and threaten its position?

One solution is competitive intelligence (CI) – a process that can drive revenue and keep brands ahead in their industry.

Let's get into what CI is, what it isn't, and how brands can harness it.

In the past, it was primarily enterprise-level companies that had the resources to invest in CI, but that's changing. In 2017, the Crayon study reported that only 37% of businesses had CI teams or dedicated CI employees. In 2020, that number grew by 20%.

Given how attainable information is online, it's now easier for small businesses to implement CI tactics without shelling out on resources.

Another thing to note about competitive intelligence is that those insights are not only for C-suite executives. With the information gathered through CI, teams in:

- Sales are equipped to fight objections and address pain points.

- Marketing can adjust their messaging to better reach their user personas.

- Product can better understand competitors' pricing and packaging models.

How to Conduct Competitive Intelligence Research

1. Identify your competitors.

With CI, you treat your industry as a game and your competitors as players. The end goal is to leverage key insights from their plays to determine your next move.

If you don't know who your competitors are, it will make it that much harder to gather valuable information.

Start by narrowing down your top direct competitors. These are brands that offer a similar product or service and target the same user persona.

Then, compile a secondary list of indirect competitors. They'll provide a different product or service but may still attract your target audience. It's good to track for inspiration rather than for competitive advantage.

Once you have your list, rank them by threat level.

2. Set objectives.

Before you start conducting CI research, set your objectives. Ask yourself and your team: "What do we want to learn? " This will help you determine which avenues to pursue and which data sources on which to focus.

Let's say high-end handbag company Amore wants to better understand its competitors' marketing strategy, specifically their messaging, campaigns, and content marketing. This is a very specific goal that gives a clear direction to your CI team. From there, the team can devise a plan to find that data.

3. Determine data collection strategies.

Now that your CI team knows the end goal, they can set up their data collection tools.

Staying with Amore's goal of understanding its competitors' marketing approach, the intel team will likely look at their websites, landing pages, blog posts, and downloadable offers – to name a few.

Social monitoring and social listening will also be valuable in understanding what content Amore's competitors are putting out there and how consumers are responding.

Having a plan of action for data collection helps CI teams stay within the scope of the project. When you cast a net too wide, it can be difficult to know where to start.

4. Gather and analyze your data.

Now that you have your competitors, goals, and research plans outlined, you can get to work.

The data gathering process can take weeks or months, depending on your goals. As you compile your data, using a CI tool will be instrumental in categorizing your data for analysis later. Jump to that section here.

Once you have enough information, things get fun. You can start looking for patterns and discover strengths and weaknesses in your competitors.

5. Relay insights to key stakeholders.

Identifying themes in your research is the first part of the process, the second is presenting your insights to key stakeholders.

They can then harness this information to further the growth of the business and generate more revenue.

One thing to keep in mind is that just like for any data analysis, you are the storyteller. You are tasked with not only analyzing it but also framing it to explain why it matters. Without that key component, it can be difficult to understand where to go next.

You'll also want to create reports tailored to the team. For instance, your sales team may find battle cards to be most useful while your marketing team may prefer a visual reporting breakdown. If you're not sure what would work best, go straight to the source. Collaborate with your teams to determine the best way to communicate your findings.

Competitive Intelligence Examples

CI work can include anything from tracking your competitors' pricing model to monitoring their social media activity. It all depends on how much time and how many resources your team is willing to invest. Here are the most popular sources and intel used for CI:

- Press releases

- Job postings

- Ad campaigns

- Lead magnets, such as ebooks, white papers, and templates

- Product and service updates (rollouts, updates to features, packages, etc ...)

- Pricing changes

- Customer review sites

- Rebranding announcements

- Website changes or redesigns

- Sales calls and client communications

- Earnings reports (for publicly traded companies)

While some of this information will be gathered by the CI team, other departments can also submit their intel. For instance, sales representatives can be especially useful when gathering intel, as they have direct contact with leads and customers.

Competitive Intelligence Best Practices

1. Stay within legal limits.

This may seem obvious but a term like competitive intelligence can give the wrong impression.

When doing any sort of CI work, you must stay within legal limits. Accessing information through illegal measures, such as hacking or phone tapping, crosses over to "espionage" territory.

If there's ever doubt on a CI approach, err on the side of caution and consult with your legal team. If you don't have an internal team, reach out to a corporate lawyer who can offer some insight on the best route to take.

2. Be ethical.

Just because it's legal, doesn't mean you should do it.

Let's say your team discovers a disgruntled employee from a competitor has recently quit and has key information on the business' strategy over the next five years.

While it's not illegal to reach out to the employee, it may be unethical as the employee may be tempted to reveal sensitive information.

Use good judgment. If it doesn't feel right, it probably isn't.

3. Share insights often.

One study by Crayon found that businesses that share CI at least once a week were twice as likely to have revenue increases than those who shared them less often.

With that in mind, sharing insights should be done often and regularly. CI is an ongoing process, not a one-and-done tactic.

As long as your company is growing, you'll need to keep an eye on the competition.

4. Contextualize reports.

An important part of CI is sharing insights regularly.

Whether it's through a newsletter, a monthly email report, or a meeting, context is everything.

For instance, let's say the CI team at Amore reports that their direct competitor Abella has launched a collaboration with a luxury clothing brand. That report should also mention how it affects Amore's positioning.

After all, the purpose of tracking competitors is to leverage that knowledge to improve your own positioning.

In this example, the collaboration with the clothing brand could solidify Abella as a luxury brand and help it move upmarket. This could weaken Amore's position and require stronger messaging surrounding the product's exclusivity and craftsmanship.

Also, insights don't happen in a vacuum. They're built over months or years of trends. As such, adding historical data can also help frame these insights and enable strategic decisions.

Competitive Intelligence Tools

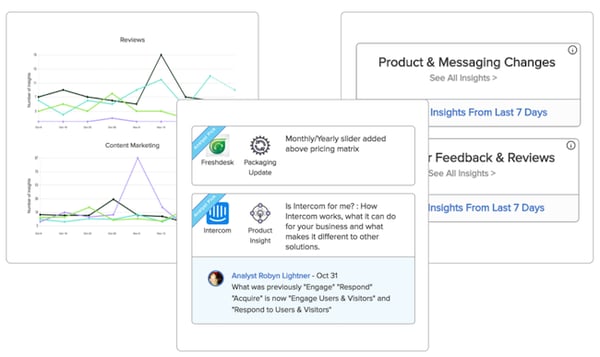

1. Crayon

Crayon is one of the leading competitive intelligence platforms in the market. The software offers a centralized platform to store and analyze data from over 300 million sources and over 100 data types.

You can track your competitors' digital footprint and easily filter through everything from social media and events to customer reviews and financial reports. The platform's top features include:

- Daily and weekly digests – You can set alerts to receive updates every time there is a change in something you're tracking, like a pricing page. Crayon also assigns a market analyst to your account to curate weekly custom reports.

- Sales battle cards – This makes battle cards easily accessible to your sales reps and has the power to analyze which plays are impacting revenue.

- Automated categorization – If your CI team is gathering data from multiple sources, Crayon automatically organizes that data for easy analysis.

To request pricing, you must contact the company.

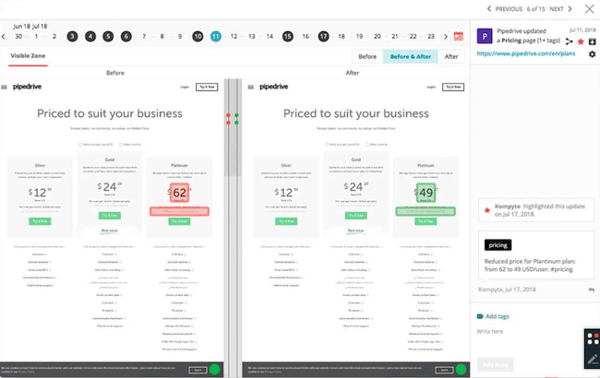

2. Kompyte

Kompyte makes it easy to visualize the changes in your competitors' pages. They have a before-and-after module that allows you to easily pinpoint changes on a page.

The tool provides details on the effectiveness of your competitors' ads, giving you insight into which opportunities are worth exploring and which ones to avoid. This includes A/B tests and targeted keywords.

Beyond that, CI teams can also set KPIs and monitor them on the platform to ensure they're on track to meet their goals and take action quickly based on performance.

To request pricing, you must contact the company.

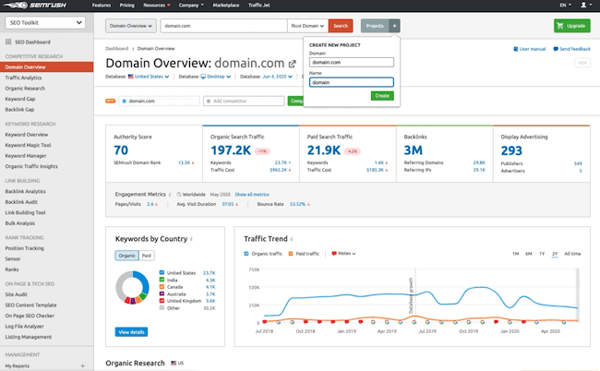

3. SEMrush

SEMrush is the place to go for a deep dive into your competitors' domain performance.

The platform allows brands to monitor other domains' authority, their link-building efforts, paid search strategies, and more across multiple channels.

They offer a free version with some access to competitive research tools. However, the paid versions – ranging from $119 to $449 a month – unlock access to traffic analytics along with several toolkits for SEO, advertising, social media, and content marketing.

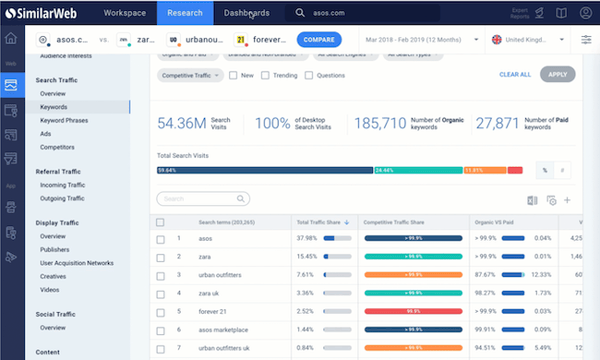

4. SimilarWeb

To get a more holistic view of your competitors' online presence for free, consider SimilarWeb.

The platform has monitoring, benchmarking, and analytics capabilities to help scaling businesses better understand their market.

From SEO and web traffic to ad placement, the platform's CI capabilities are extensive in both free and paid versions. For pricing details on the enterprise plans, you must reach talk to a SimilarWeb consultant.

5. Visualping

If you're low on resources or don't need an extensive CI program, Visualping is an easy and free way to keep track of your competitors and their website changes.

The site monitors website changes and alerts you via email, text, Slack, or API. You can specify what areas of the page you would like to track along with how often you'd like to be alerted.

All you need to start is an email and a website to track. However, for business use, the monthly cost ranges from $20 to $135.

The key takeaway is that when running a business, staying in your lane is important but that doesn't mean you shouldn't look left or right from time to time to see what everyone else is up to. When done right, CI can be an incredible asset to every brand.

from Marketing https://ift.tt/2svs5EE

via

![Access Now: 10 Competitive Analysis Tempates [Free Download]](https://no-cache.hubspot.com/cta/default/53/b3ec18aa-f4b2-45e9-851f-6d359263e671.png)

No comments:

Post a Comment